Question: 4. Refer to the observed capital structures given in Table 16.7 from Section 16.9: Observed Capital Structures of the textbook. What do you notice about

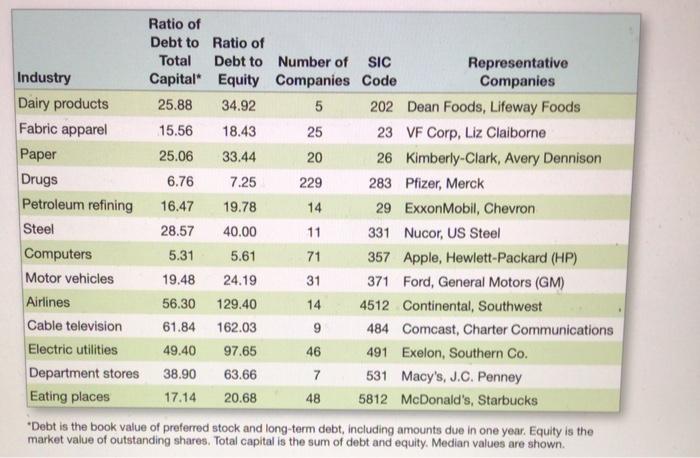

4. Refer to the observed capital structures given in Table 16.7 from Section 16.9: Observed Capital Structures of the textbook. What do you notice about the types of industries with respect to their average debt/equity ratios? Are certain types of industries more likely to be highly leveraged than others? What are some possible reasons for this observed segmentation? Do the operating results and tax history of the firms play a role? How about their future earnings prospects? Explain. (10 marks) market value of outstanding shares. Total capital is the sum of debt and equity. Median values are shown

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts