Question: 4. Rick, a computer consultant, owns a separate business (not real estate) in which he participates. He has one employee who works part-time in the

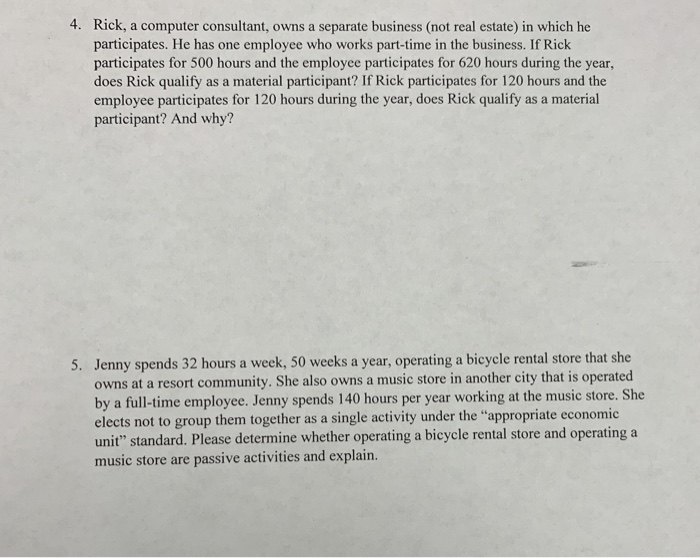

4. Rick, a computer consultant, owns a separate business (not real estate) in which he participates. He has one employee who works part-time in the business. If Rick participates for 500 hours and the employee participates for 620 hours during the year, does Rick qualify as a material participant? If Rick participates for 120 hours and the employee participates for 120 hours during the year, does Rick qualify as a material participant? And why? Jenny spends 32 hours a week, 50 weeks a year, operating a bicycle rental store that she owns at a resort community. She also owns a music store in another city that is operated by a full-time employee. Jenny spends 140 hours per year working at the music store. She elects not to group them together as a single activity under the "appropriate economic unit" standard. Please determine whether operating a bicycle rental store and operatinga music store are passive activities and explain. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts