Question: 4). Rocky has a full-time job as an electrical engineer for the city utility company. In his spare time, Rocky repairs TV sets in the

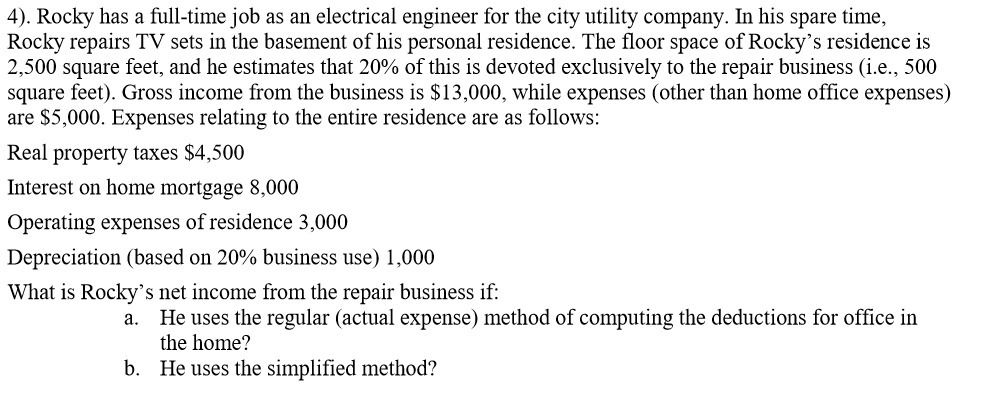

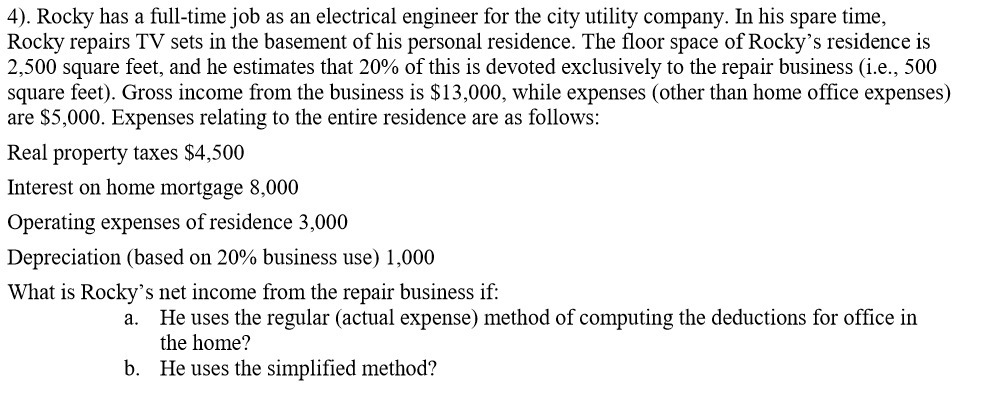

4). Rocky has a full-time job as an electrical engineer for the city utility company. In his spare time, Rocky repairs TV sets in the basement of his personal residence. The oor space of Rocky's residence is 2,500 square feet, and he estimates that 20% of this is devoted exclusively to the repair business (i.e., 500 square feet). Gross income from the business is $13,000, while expenses (other than home ofce expenses) are $5,000. Expenses relating to the entire residence are as follows: Real property taxes $4,500 Interest on home mortgage 8,000 Operating expenses of residence 3,000 Depreciation (based on 20% business use) 1,000 What is Rocky's net income from the repair business if: a. He uses the regular (actual expense) method of computing the deductions for ofce in the home? b. He uses the simplified method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts