Question: 4. Should UST Inc. undertake the $1 billion recapitalization? Assuming the entire recapitalization is implemented immediately on 01/01/1999. Fill out the following form and show

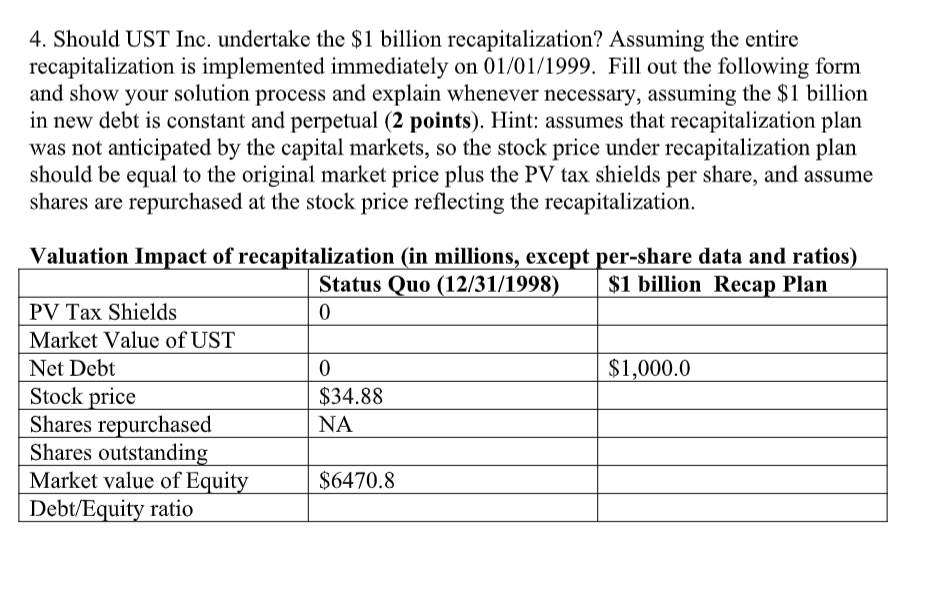

4. Should UST Inc. undertake the $1 billion recapitalization? Assuming the entire recapitalization is implemented immediately on 01/01/1999. Fill out the following form and show your solution process and explain whenever necessary, assuming the $1 billion in new debt is constant and perpetual (2 points). Hint: assumes that recapitalization plan was not anticipated by the capital markets, so the stock price under recapitalization plan should be equal to the original market price plus the PV tax shields per share, and assume shares are repurchased at the stock price reflecting the recapitalization. Valuation Impact of recapitalization in millions, except per-share data and ratios) Status Quo (12/31/1998) $1 billion Recap Plan PV Tax Shields Market Value of UST Net Debt 0 $1,000.0 Stock price $34.88 Shares repurchased NA Shares outstanding Market value of Equity $6470.8 Debt/Equity ratio 4. Should UST Inc. undertake the $1 billion recapitalization? Assuming the entire recapitalization is implemented immediately on 01/01/1999. Fill out the following form and show your solution process and explain whenever necessary, assuming the $1 billion in new debt is constant and perpetual (2 points). Hint: assumes that recapitalization plan was not anticipated by the capital markets, so the stock price under recapitalization plan should be equal to the original market price plus the PV tax shields per share, and assume shares are repurchased at the stock price reflecting the recapitalization. Valuation Impact of recapitalization in millions, except per-share data and ratios) Status Quo (12/31/1998) $1 billion Recap Plan PV Tax Shields Market Value of UST Net Debt 0 $1,000.0 Stock price $34.88 Shares repurchased NA Shares outstanding Market value of Equity $6470.8 Debt/Equity ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts