Question: 4 - Silver Ltd . is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker

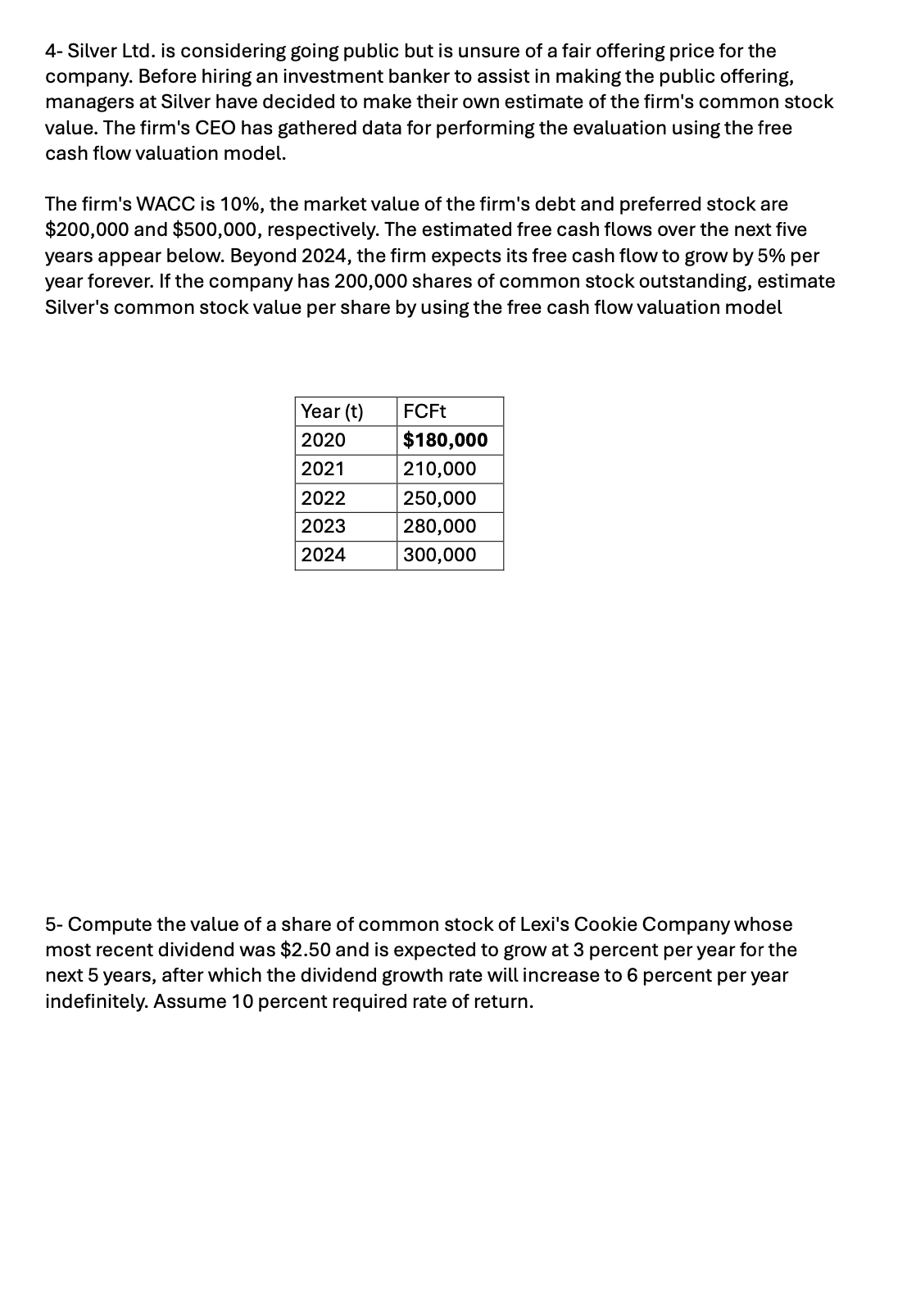

Silver Ltd is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Silver have decided to make their own estimate of the firm's common stock value. The firm's CEO has gathered data for performing the evaluation using the free cash flow valuation model.

The firm's WACC is the market value of the firm's debt and preferred stock are $ and $ respectively. The estimated free cash flows over the next five years appear below. Beyond the firm expects its free cash flow to grow by per year forever. If the company has shares of common stock outstanding, estimate Silver's common stock value per share by using the free cash flow valuation model

Compute the value of a share of common stock of Lexi's Cookie Company whose most recent dividend was $ and is expected to grow at percent per year for the next years, after which the dividend growth rate will increase to percent per year indefinitely. Assume percent required rate of return.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock