Question: 4. Sirius, Inc. is considering a 3 year project that requires an initial investment of $2.7 million. The asset will be depreciated straight-line to zero

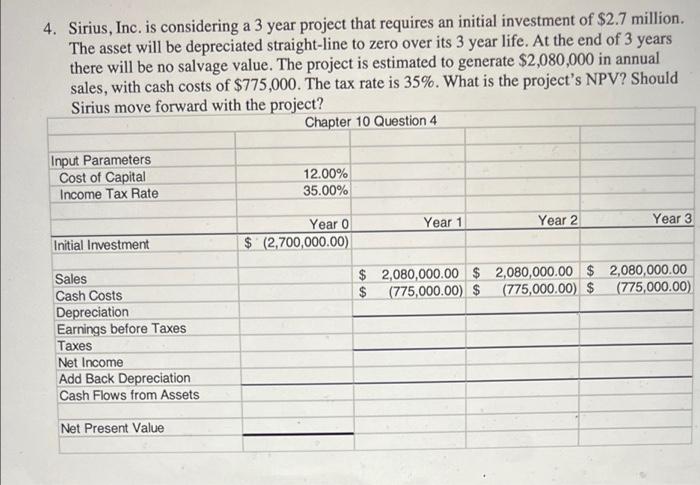

4. Sirius, Inc. is considering a 3 year project that requires an initial investment of $2.7 million. The asset will be depreciated straight-line to zero over its 3 year life. At the end of 3 years there will be no salvage value. The project is estimated to generate $2,080,000 in annual sales, with cash costs of $775,000. The tax rate is 35%. What is the project's NPV? Should Sirius move forward with the project? Chapter 10 Question 4 Input Parameters Cost of Capital Income Tax Rate 12.00% 35.00% Year 1 Year 2 Year 3 Year 0 $ (2,700,000.00) Initial Investment $ 2,080,000.00 $ 2,080,000.00 $ 2,080,000.00 $ (775,000.00) $ (775,000.00) $ (775,000.00 Sales Cash Costs Depreciation Earnings before Taxes Taxes Net Income Add Back Depreciation Cash Flows from Assets Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts