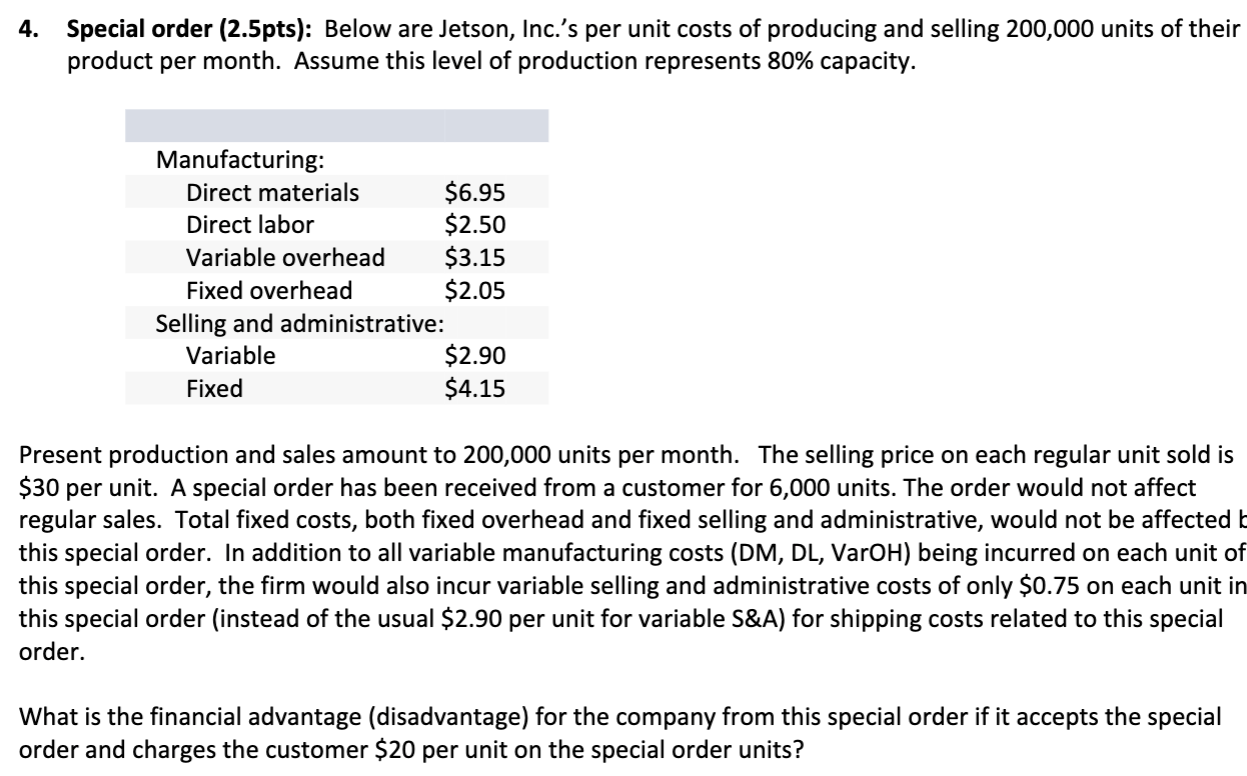

Question: 4. Special order (2.5pts): Below are Jetson, Inc.'s per unit costs of producing and selling 200,000 units of their product per month. Assume this level

4. Special order (2.5pts): Below are Jetson, Inc.'s per unit costs of producing and selling 200,000 units of their product per month. Assume this level of production represents 80% capacity. Present production and sales amount to 200,000 units per month. The selling price on each regular unit sold is $30 per unit. A special order has been received from a customer for 6,000 units. The order would not affect regular sales. Total fixed costs, both fixed overhead and fixed selling and administrative, would not be affected this special order. In addition to all variable manufacturing costs (DM, DL, VarOH) being incurred on each unit of this special order, the firm would also incur variable selling and administrative costs of only $0.75 on each unit in this special order (instead of the usual \$2.90 per unit for variable S\&A) for shipping costs related to this special order. What is the financial advantage (disadvantage) for the company from this special order if it accepts the special order and charges the customer $20 per unit on the special order units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts