Question: 4) Suppose the data is described by a one-factor model, where the unobserved factor has mean zero and unit variance. You obtain the following estimates

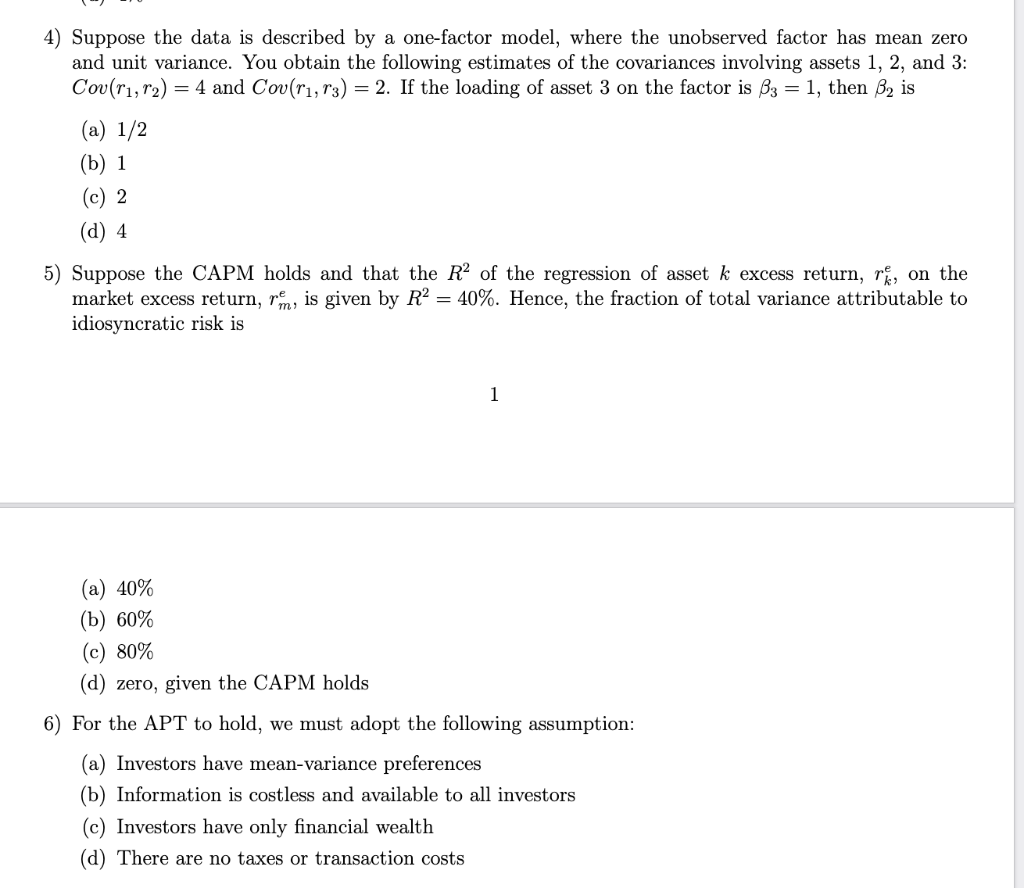

4) Suppose the data is described by a one-factor model, where the unobserved factor has mean zero and unit variance. You obtain the following estimates of the covariances involving assets 1, 2, and 3: Cov(r1, 12) = 4 and Cov(r, r3) = 2. If the loading of asset 3 on the factor is 63 = 1, then 3 is (a) 1/2 (b) 1 (c) 2 (d) 4 5) Suppose the CAPM holds and that the R of the regression of asset k excess return, r, on the market excess return, re, is given by R = 40%. Hence, the fraction of total variance attributable to idiosyncratic risk is 1 (a) 40% (b) 60% (c) 80% (d) zero, given the CAPM holds 6) For the APT to hold, we must adopt the following assumption: (a) Investors have mean-variance preferences (b) Information is costless and available to all investors (c) Investors have only financial wealth (d) There are no taxes or transaction costs 4) Suppose the data is described by a one-factor model, where the unobserved factor has mean zero and unit variance. You obtain the following estimates of the covariances involving assets 1, 2, and 3: Cov(r1, 12) = 4 and Cov(r, r3) = 2. If the loading of asset 3 on the factor is 63 = 1, then 3 is (a) 1/2 (b) 1 (c) 2 (d) 4 5) Suppose the CAPM holds and that the R of the regression of asset k excess return, r, on the market excess return, re, is given by R = 40%. Hence, the fraction of total variance attributable to idiosyncratic risk is 1 (a) 40% (b) 60% (c) 80% (d) zero, given the CAPM holds 6) For the APT to hold, we must adopt the following assumption: (a) Investors have mean-variance preferences (b) Information is costless and available to all investors (c) Investors have only financial wealth (d) There are no taxes or transaction costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts