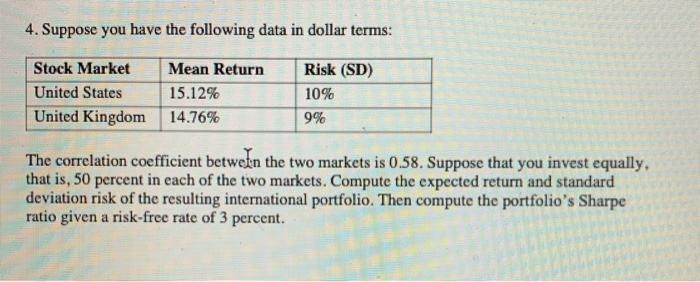

Question: 4. Suppose you have the following data in dollar terms: Stock Market United States United Kingdom Mean Return 15.12% 14.76% Risk (SD) 10% 9% The

4. Suppose you have the following data in dollar terms: Stock Market United States United Kingdom Mean Return 15.12% 14.76% Risk (SD) 10% 9% The correlation coefficient between the two markets is 0.58. Suppose that you invest equally, that is, 50 percent in each of the two markets. Compute the expected return and standard deviation risk of the resulting international portfolio. Then compute the portfolio's Sharpe ratio given a risk-free rate of 3 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts