Question: 4 - Tableau Assignment i Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It

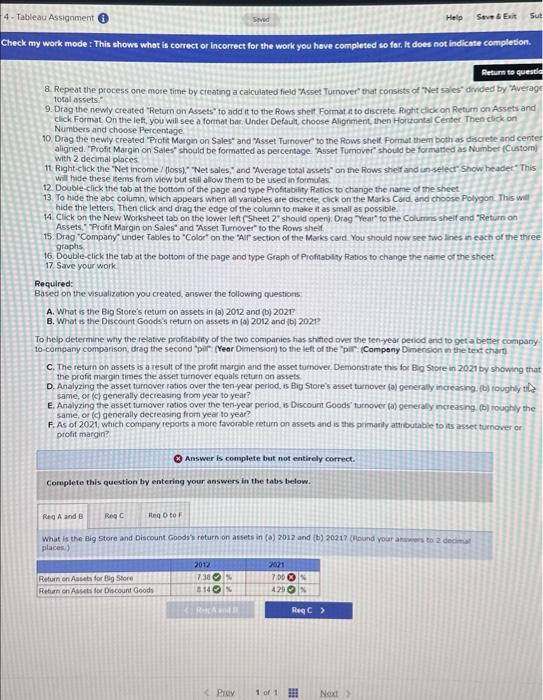

8 Repeat the process one more time by cieatng a calculated field "Asset Turnover" that consists of "Wet sai es" chrofed by "Averag tosal aspets: 9. Drag the newly created "Return on Assets" to add it to the Powes shelt Format an to discrete foght chick on Return orn Assets and chick Format. On the lef, you willsee a forinat bar. Under Default, choose Alignment, then Horichtal Center. Then cick on Numbers and choose Prricentatye 10 Brag the newty created "Profit Margan on Sales" and "Asset Turndver" to the Rows shelf. Formatt them both as dascrete and centes aligned. "Profit Margin on Sales" should be formatted as percentage. "Asset furnover" should be formatted as Number (Custorm) with 2 decimal places 11. Right-click the "Nes incomed (Joss). NNet sales, and "Average tokal assels" on the Rows sheit and un-seleat" show header" Fhis Will hide these items from vicw but still aliow them to be used in formalas 12 Dooblectick the tab at the bottorn of the page and type Profitabily Ratics to change the name of the sheet 13 To hide the abe columtn, wilich appears when all variables afe discrete. chick on the Marks Cond. and chogse Polygori This wil. hide the letters. Then click and drog the edpe of the columm to make it as small as possible. 14. Click on the New Worksheet tab on the lower left Pheet 2 " should openy. Drag "Yeat" fo the Colurnas sheif and "Return on Assets," Protit Margin on Sales" and "Asset Turnover" to the Rows shet, 15. Drast "Company" under Tables to "Colot" on the "Air section of the Marks card You should now see tivo kines ah tach of the three graphs 16. Double-lick the tab at the bottom of the page and type Graph of Profitabilfy Ratios to change the name of the shcet 17. Sarve your work Required: Based on the visualization you created. answer the following questions A. What is the Bip Store's fetuin on assets in (a) 2012 and (b)2021 ? B. What is the Dicount Goods's return on assets in (a) 2012 and (b)2021 ? To heip determine wily the relative profiabdify of the fwo companies has shitiod over the tentyear pericid and to gect a bether compuny. to-compary comparison, drag the second "pil? fYeer Dimension) to the ieft of the "pir? gCompony Damension th the teat charti C. The return on assets is a result of the profit wargin arid the assem turtover. Bemonstrate thes foe Big 5 biof e un 20271 by shawing that the profit margin times the asser turnover equals return an assets D. Aaalyzing the asset turnover ratios over the ten-pear period, is Bro Store's asset tumpover (a) generaly increasing (b) foughly til same, or (c) generally decreasing from year to year? E. Aralyzing the asset tumover ratios ovel the tert-ycar period. is Discocint Goods' futnover (a) generahy mareasing. (b) rouphly the sante, or (c) gencrally decteosing fiom yeat to year? F. As of 2021, weich connpany repaits al more favorable return on assets and is ahes primanily attilouthbies to its assect turnover or prolit margin? (3) Answer is comalete bet not entirely correct. Complete this question by entering your answers in the tabs below. placess, 8 Repeat the process one more time by cieatng a calculated field "Asset Turnover" that consists of "Wet sai es" chrofed by "Averag tosal aspets: 9. Drag the newly created "Return on Assets" to add it to the Powes shelt Format an to discrete foght chick on Return orn Assets and chick Format. On the lef, you willsee a forinat bar. Under Default, choose Alignment, then Horichtal Center. Then cick on Numbers and choose Prricentatye 10 Brag the newty created "Profit Margan on Sales" and "Asset Turndver" to the Rows shelf. Formatt them both as dascrete and centes aligned. "Profit Margin on Sales" should be formatted as percentage. "Asset furnover" should be formatted as Number (Custorm) with 2 decimal places 11. Right-click the "Nes incomed (Joss). NNet sales, and "Average tokal assels" on the Rows sheit and un-seleat" show header" Fhis Will hide these items from vicw but still aliow them to be used in formalas 12 Dooblectick the tab at the bottorn of the page and type Profitabily Ratics to change the name of the sheet 13 To hide the abe columtn, wilich appears when all variables afe discrete. chick on the Marks Cond. and chogse Polygori This wil. hide the letters. Then click and drog the edpe of the columm to make it as small as possible. 14. Click on the New Worksheet tab on the lower left Pheet 2 " should openy. Drag "Yeat" fo the Colurnas sheif and "Return on Assets," Protit Margin on Sales" and "Asset Turnover" to the Rows shet, 15. Drast "Company" under Tables to "Colot" on the "Air section of the Marks card You should now see tivo kines ah tach of the three graphs 16. Double-lick the tab at the bottom of the page and type Graph of Profitabilfy Ratios to change the name of the shcet 17. Sarve your work Required: Based on the visualization you created. answer the following questions A. What is the Bip Store's fetuin on assets in (a) 2012 and (b)2021 ? B. What is the Dicount Goods's return on assets in (a) 2012 and (b)2021 ? To heip determine wily the relative profiabdify of the fwo companies has shitiod over the tentyear pericid and to gect a bether compuny. to-compary comparison, drag the second "pil? fYeer Dimension) to the ieft of the "pir? gCompony Damension th the teat charti C. The return on assets is a result of the profit wargin arid the assem turtover. Bemonstrate thes foe Big 5 biof e un 20271 by shawing that the profit margin times the asser turnover equals return an assets D. Aaalyzing the asset turnover ratios over the ten-pear period, is Bro Store's asset tumpover (a) generaly increasing (b) foughly til same, or (c) generally decreasing from year to year? E. Aralyzing the asset tumover ratios ovel the tert-ycar period. is Discocint Goods' futnover (a) generahy mareasing. (b) rouphly the sante, or (c) gencrally decteosing fiom yeat to year? F. As of 2021, weich connpany repaits al more favorable return on assets and is ahes primanily attilouthbies to its assect turnover or prolit margin? (3) Answer is comalete bet not entirely correct. Complete this question by entering your answers in the tabs below. placess

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts