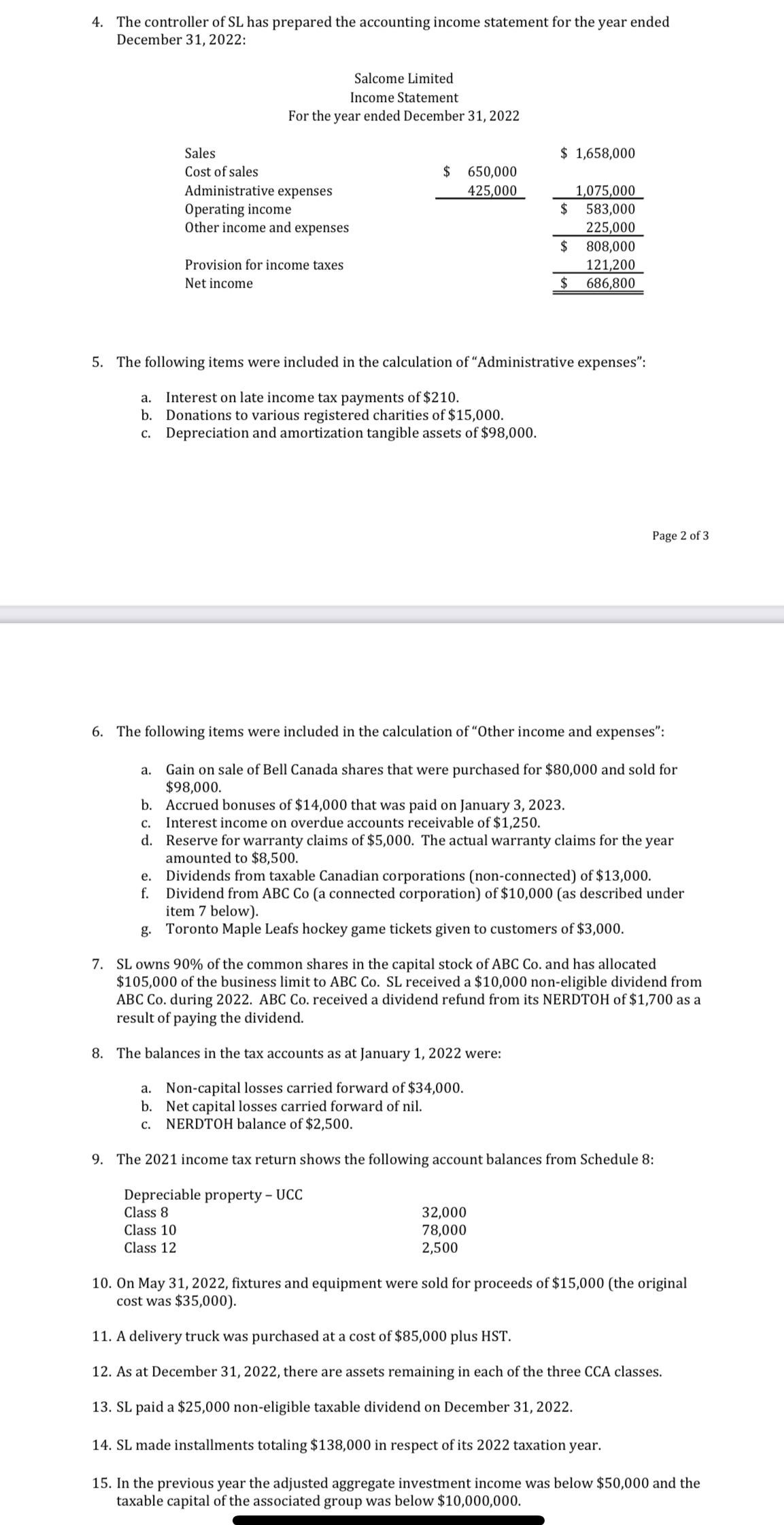

Question: 4. The controller ofSL has prepared the accounting intome statement for the year ended December 31, 2022: Salcome Limited Income Statement For the year ended

4. The controller ofSL has prepared the accounting intome statement for the year ended December 31, 2022: Salcome Limited Income Statement For the year ended December 31, 2022 Sales $ 1,658,000 Cost ofsales $ 650,000 Administrative expenses 425 000 1 075,000 Operating income $ 583,000 Other income and expenses 225,000 $ 808,000 Provision for income taxes 121,200 Net income $ 686,800 5. The following items were included in the calculation of "Administrative expenses\": a. Interest on late income tax payments of$210. h. Donations to various registered charities of $15,000. c. Depreciation and amortization tangible assets of$98,000. Page 2 of3 6. The following items were included in the calculation of "Other income and expenses\": a. Gain on sale of Bell Canada shares that were purchased for $80,000 and sold for $98,000. b. Accrued bonuses of$14,000 that was paid on ]anuary 3, 2023. c. interest income on overdue accounts receivable of$1,250. d. Reserve for warranty claims of $5,000. The actual warranty claims for the year amounted to $8,500. e. Dividends from taxable Canadian corporations [non-connected] of$13,000. f. Dividend from ABC Co (a connected corporation] of$10,000 (as described under item 7 below]. g. Toronto Maple Leafs hockey game tickets given to customers of$3,000. 7. SL owns 90% ofthe common shares in the capital stock ofABC Co. and has allocated $105,000 of the business limit to ABC Co. SL received a $10,000 non-eligible dividend from ABC Co. during 2022. ABC Co. received a dividend refund from its NERDTOH of$1,700 as a result of paying the dividend. 8. The balances in the tax accounts as at January 1, 2022 were: a. Non-capital losses carried forward of $34,000. b. Net capital losses carried forward of nil. c. NERDTOH balance of$2,500. 9. The 2021 income tax return shows the following account balances from Schedule 8: Depreciable property UCC Class 8 32,000 Class 10 78,000 Class 12 2,500 10. On May 31, 2022, xtures and equipment were sold for proceeds of$15,000 (the original cost was $35,000]. 11. A delivery truck was purchased at a cost of$85.000 plus HST. 12. As at December 31, 2022, there are assets remaining in each of the three CCA classes. 13. SL paid a $25,000 non-eligible taxable dividend on December 31, 2022. 14. SL made installments totaling $138,000 in respect of its 2022 taxation year. 15. In the previous year the adjusted aggregate investment income was below $50,000 and the taxable capital of the associated group was below $10,000,000.