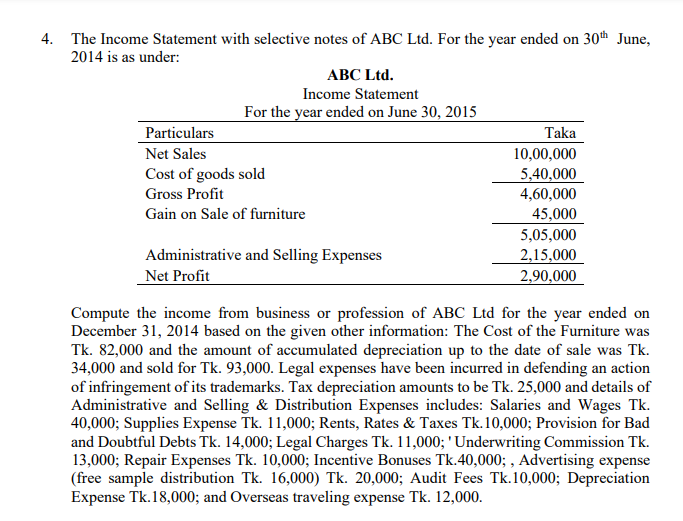

Question: 4. The Income Statement with selective notes of ABC Ltd. For the year ended on 30th June, 2014 is as under: ABC Ltd. Income Statement

4. The Income Statement with selective notes of ABC Ltd. For the year ended on 30th June, 2014 is as under: ABC Ltd. Income Statement For the year ended on June 30, 2015 Particulars Taka Net Sales 10,00,000 Cost of goods sold 5.40,000 Gross Profit 4,60,000 Gain on Sale of furniture 45,000 5,05,000 Administrative and Selling Expenses 2,15,000 Net Profit 2,90,000 Compute the income from business or profession of ABC Ltd for the year ended on December 31, 2014 based on the given other information: The Cost of the Furniture was Tk. 82,000 and the amount of accumulated depreciation up to the date of sale was Tk. 34,000 and sold for Tk. 93,000. Legal expenses have been incurred in defending an action of infringement of its trademarks. Tax depreciation amounts to be Tk. 25,000 and details of Administrative and Selling & Distribution Expenses includes: Salaries and Wages Tk. 40,000; Supplies Expense Tk. 11,000; Rents, Rates & Taxes Tk. 10,000; Provision for Bad and Doubtful Debts Tk. 14,000; Legal Charges Tk. 11,000; ' Underwriting Commission TK. 13,000; Repair Expenses Tk. 10,000; Incentive Bonuses Tk.40,000; , Advertising expense (free sample distribution Tk. 16,000) Tk. 20,000; Audit Fees Tk. 10,000; Depreciation Expense Tk. 18,000; and Overseas traveling expense Tk. 12,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts