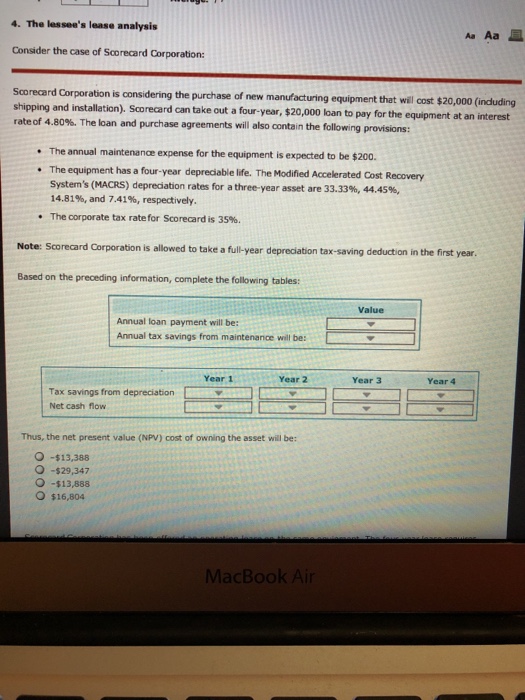

Question: 4- The lessee's lease analysis A Aa Consider the case of Scorecard Corporation Scorecard Corporation is considering the purchase of new manufacturing equipment that will

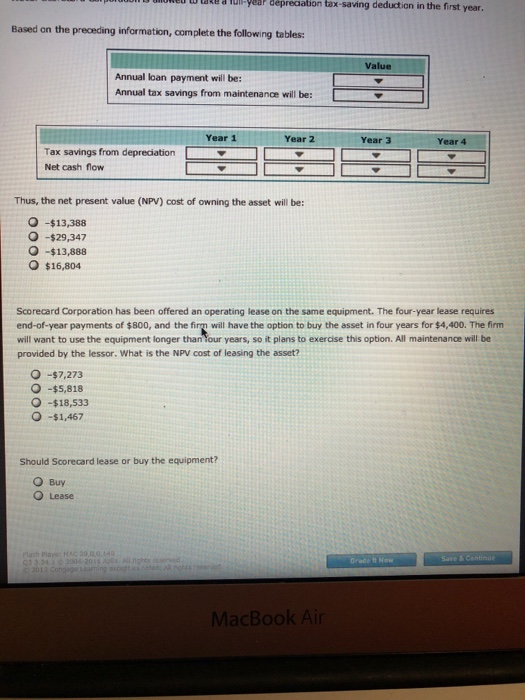

4- The lessee's lease analysis A Aa Consider the case of Scorecard Corporation Scorecard Corporation is considering the purchase of new manufacturing equipment that will cost $20,000 (indluding ing and installation). Scorecard can take out a four-year, $20,000 loan to pay for the equipment at an interest rate of 4.80%. The loan and purchase agreements will also contain the following provisions: . The annual maintenance expense for the equipment is expected to be $200. The equipment has a four-year depreciable life. The Modified Accelerated Cost Recovery System's (MACRS) depreciation rates for a three-year asset are 33.33%, 44.45%, 14.81%, and 7.41%, respectively. The corporate tax rate for Scorecard is 35%. * Note: Scorecard Corporation is allowed to take a full-year depreciation tax-saving deduction in the first year. Based on the preceding information, complete the following tables: Value Annual loan payment will be: Annual tax savings from maintenance will be: Year 1 Year 2 Year 3 Year 4 Tax savings from depreciation Net cash flow Thus, the net present value (NPV) cost of owning the asset will be: O -$13,388 O -$29,347 O -$13,888 o $16,804 MacBook Ai

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts