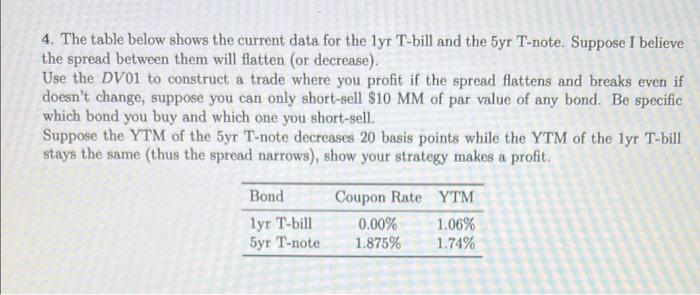

Question: 4. The table below shows the current data for the lyr T-bill and the 5yr T-note. Suppose I believe the spread between them will flatten

4. The table below shows the current data for the lyr T-bill and the 5yr T-note. Suppose I believe the spread between them will flatten (or decrease). Use the DV01 to construct a trade where you profit if the spread flattens and breaks even if doesn't change, suppose you can only short-sell $10 MM of par value of any bond. Be specific which bond you buy and which one you short-sell. Suppose the YTM of the 5yr T-note decreases 20 basis points while the YTM of the lyr T-bill stays the same (thus the spread narrows), show your strategy makes a profit. Bond lyr T-bill 5yr T-note Coupon Rate YTM 0.00% 1.06% 1.875% 1.74% 4. The table below shows the current data for the lyr T-bill and the 5yr T-note. Suppose I believe the spread between them will flatten (or decrease). Use the DV01 to construct a trade where you profit if the spread flattens and breaks even if doesn't change, suppose you can only short-sell $10 MM of par value of any bond. Be specific which bond you buy and which one you short-sell. Suppose the YTM of the 5yr T-note decreases 20 basis points while the YTM of the lyr T-bill stays the same (thus the spread narrows), show your strategy makes a profit. Bond lyr T-bill 5yr T-note Coupon Rate YTM 0.00% 1.06% 1.875% 1.74%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts