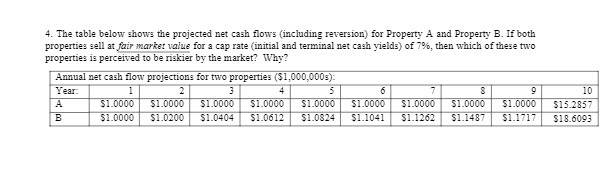

Question: 4. The table below shows the projected net cash flows (including reversion) for Property A and Property B. If both properties sell at fair market

4. The table below shows the projected net cash flows (including reversion) for Property A and Property B. If both properties sell at fair market value for a cap rate (initial and terminal net cash yields) of 79%, then which of these two properties is perceived to be riskier by the market? Why? Annual net cash flow projections for two properties ($1,000,0009); Year. 4 6 9 10 $1.0000 $1.0000 $1.0000 $1.0000 $1.0000 51.0000 $1.0000 $1.0000 $1.0000 515.2857 B $1.0000 $1.0200 $1 0404 51.0612 $1.0824 $1.1041 $1.1262 $1.1487 $1.1717 $18 6093

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts