Question: 4. The US treasury has two bonds outstanding, both with 2.0% coupon rate. The first has one year to maturity, the second 20 years to

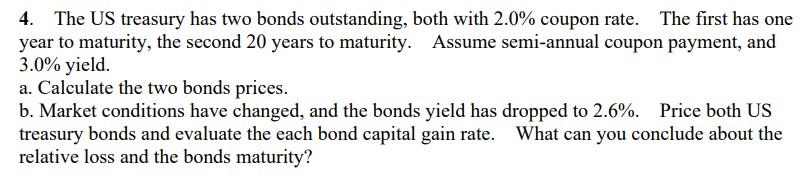

4. The US treasury has two bonds outstanding, both with 2.0% coupon rate. The first has one year to maturity, the second 20 years to maturity. Assume semi-annual coupon payment, and 3.0% yield. a. Calculate the two bonds prices. b. Market conditions have changed, and the bonds yield has dropped to 2.6%. Price both US treasury bonds and evaluate the each bond capital gain rate. What can you conclude about the relative loss and the bonds maturity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock