Question: ~4) There are two ways to calculate the expected return of a portfolio: Either calculate the expected return using the value and dividend stream of

~4)

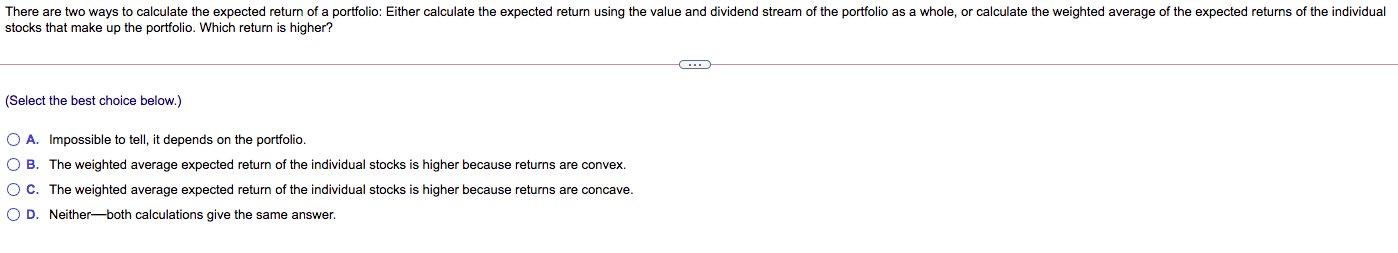

There are two ways to calculate the expected return of a portfolio: Either calculate the expected return using the value and dividend stream of the portfolio as a whole, or calculate the weighted average of the expected returns of the individual stocks that make up the portfolio. Which return is higher? (Select the best choice below.) O A. Impossible to tell, it depends on the portfolio. OB. The weighted average expected return of the individual stocks is higher because returns are convex. OC. The weighted average expected return of the individual stocks is higher because returns are concave. OD. Neitherboth calculations give the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts