Question: 4 . This question asks you to use the General Monetary Model of the Exchange Rate. Assume that we are in the long run, that

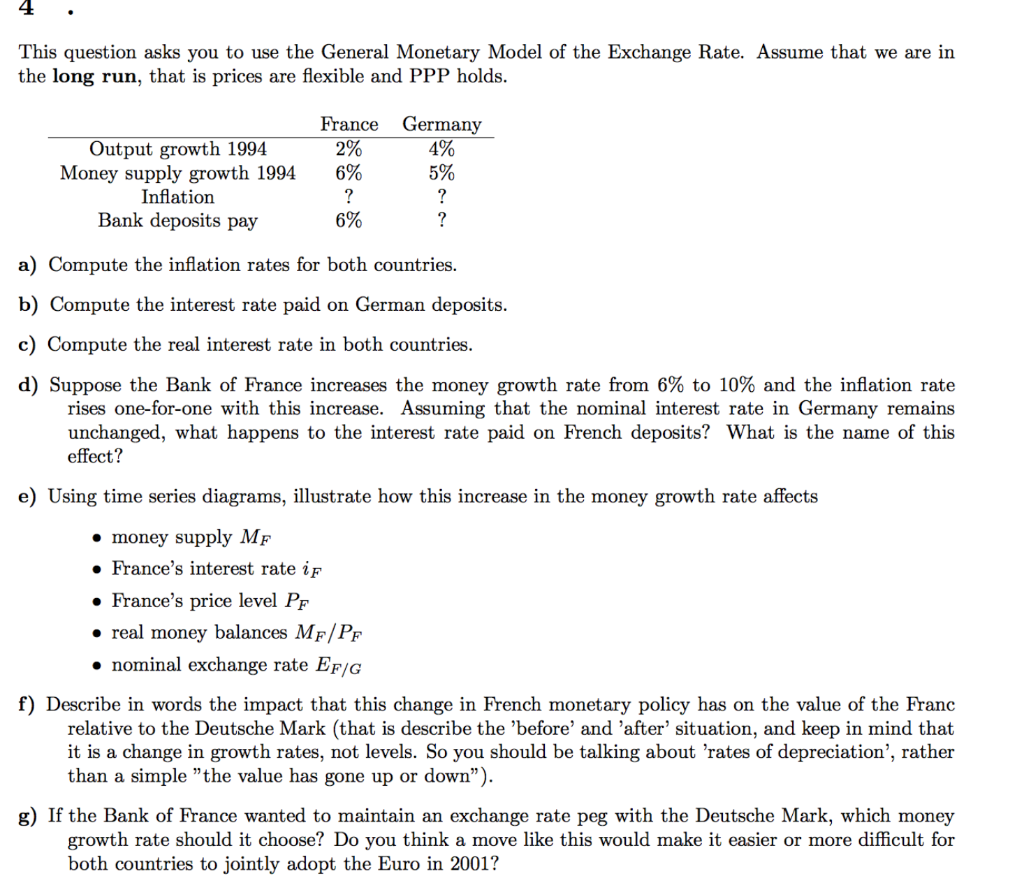

4 . This question asks you to use the General Monetary Model of the Exchange Rate. Assume that we are in the long run, that is prices are flexible and PPP holds. 4% France Germany 2% 6% ? Output growth 1994 Money supply growth 1994 Inflation Bank deposits pay 5% 6% a) Compute the inflation rates for both countries. b) Compute the interest rate paid on German deposits. c) Compute the real interest rate in both countries. d) Suppose the Bank of France increases the money growth rate from 6% to 10% and the inflation rate rises one-for-one with this increase. Assuming that the nominal interest rate in Germany remains unchanged, what happens to the interest rate paid on French deposits? What is the name of this effect? e) Using time series diagrams, illustrate how this increase in the money growth rate affects money supply MF France's interest rate if France's price level PF real money balances MF/PF nominal exchange rate EF/G f) Describe in words the impact that this change in French monetary policy has on the value of the Franc relative to the Deutsche Mark (that is describe the 'before' and 'after situation, and keep in mind that it is a change in growth rates, not levels. So you should be talking about 'rates of depreciation', rather than a simple "the value has gone up or down"). g) If the Bank of France wanted to maintain an exchange rate peg with the Deutsche Mark, which money growth rate should it choose? Do you think a move like this would make it easier or more difficult for both countries to jointly adopt the Euro in 2001? 4 . This question asks you to use the General Monetary Model of the Exchange Rate. Assume that we are in the long run, that is prices are flexible and PPP holds. 4% France Germany 2% 6% ? Output growth 1994 Money supply growth 1994 Inflation Bank deposits pay 5% 6% a) Compute the inflation rates for both countries. b) Compute the interest rate paid on German deposits. c) Compute the real interest rate in both countries. d) Suppose the Bank of France increases the money growth rate from 6% to 10% and the inflation rate rises one-for-one with this increase. Assuming that the nominal interest rate in Germany remains unchanged, what happens to the interest rate paid on French deposits? What is the name of this effect? e) Using time series diagrams, illustrate how this increase in the money growth rate affects money supply MF France's interest rate if France's price level PF real money balances MF/PF nominal exchange rate EF/G f) Describe in words the impact that this change in French monetary policy has on the value of the Franc relative to the Deutsche Mark (that is describe the 'before' and 'after situation, and keep in mind that it is a change in growth rates, not levels. So you should be talking about 'rates of depreciation', rather than a simple "the value has gone up or down"). g) If the Bank of France wanted to maintain an exchange rate peg with the Deutsche Mark, which money growth rate should it choose? Do you think a move like this would make it easier or more difficult for both countries to jointly adopt the Euro in 2001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts