Question: 4. This question concerns foreign exchange. a. Give two challenges which we face when modelling FX rates compared to modelling equities. [2 marks] b. You

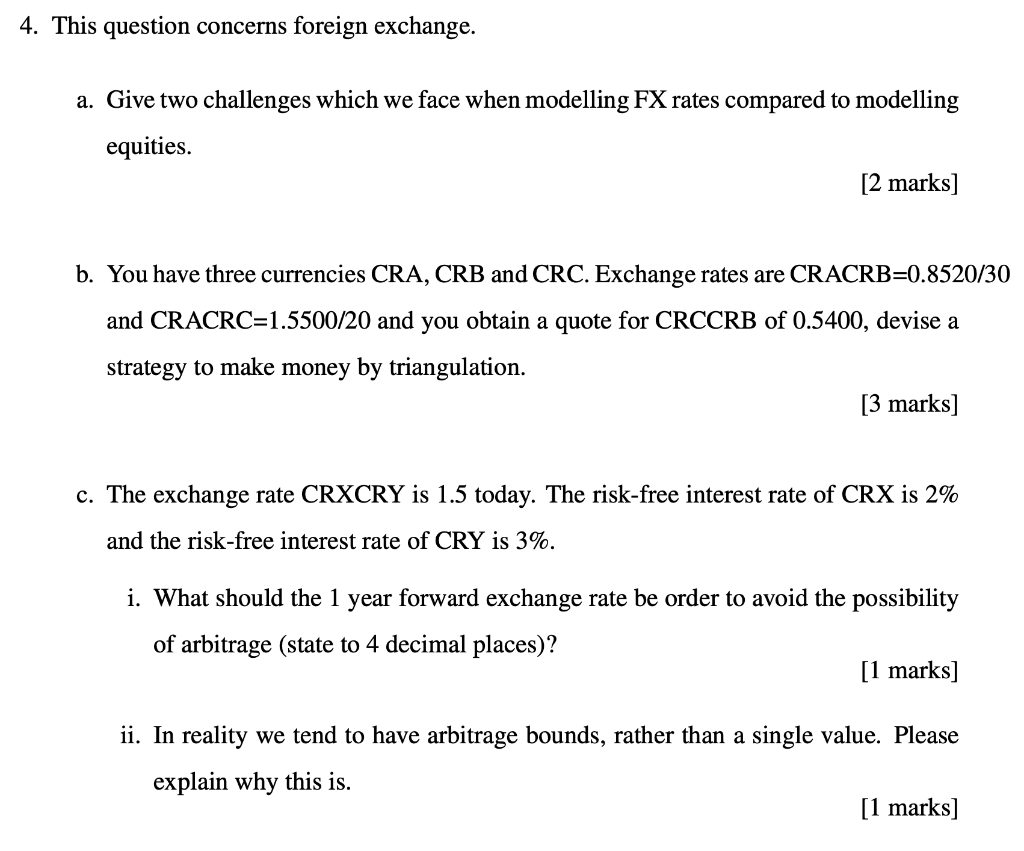

4. This question concerns foreign exchange. a. Give two challenges which we face when modelling FX rates compared to modelling equities. [2 marks] b. You have three currencies CRA, CRB and CRC. Exchange rates are CRACRB=0.8520/30 and CRACRC=1.5500/20 and you obtain a quote for CRCCRB of 0.5400, devise a strategy to make money by triangulation. [3 marks] c. The exchange rate CRXCRY is 1.5 today. The risk-free interest rate of CRX is 2% and the risk-free interest rate of CRY is 3%. i. What should the 1 year forward exchange rate be order to avoid the possibility of arbitrage (state to 4 decimal places)? [1 marks] ii. In reality we tend to have arbitrage bounds, rather than a single value. Please explain why this is. [1 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts