Question: 4) (This question is from the 2016 Winter Final Exam. As long as you attempt all parts you will receive full credit.) Today is t

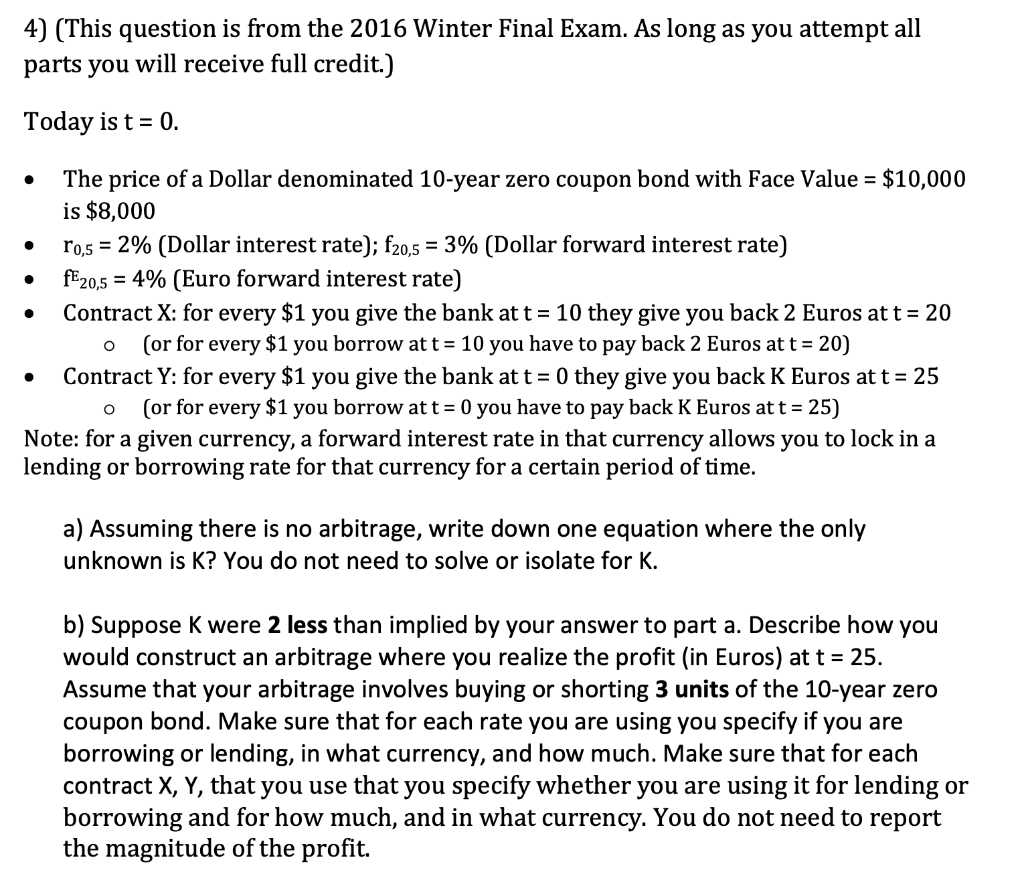

4) (This question is from the 2016 Winter Final Exam. As long as you attempt all parts you will receive full credit.) Today is t = 0. . . The price of a Dollar denominated 10-year zero coupon bond with Face Value = $10,000 is $8,000 r0,5 = 2% (Dollar interest rate); f20,5 = 3% (Dollar forward interest rate) fE20,5 = 4% (Euro forward interest rate) Contract X: for every $1 you give the bank at t = 10 they give you back 2 Euros at t = 20 o (or for every $1 you borrow at t = 10 you have to pay back 2 Euros at t = 20) Contract Y: for every $1 you give the bank at t = 0 they give you back K Euros at t = 25 o (or for every $1 you borrow at t = 0 you have to pay back K Euros at t = 25) Note: for a given currency, a forward interest rate in that currency allows you to lock in a lending or borrowing rate for that currency for a certain period of time. a) Assuming there is no arbitrage, write down one equation where the only unknown is K? You do not need to solve or isolate for K. b) Suppose K were 2 less than implied by your answer to part a. Describe how you would construct an arbitrage where you realize the profit (in Euros) at t = 25. Assume that your arbitrage involves buying or shorting 3 units of the 10-year zero coupon bond. Make sure that for each rate you are using you specify if you are borrowing or lending, in what currency, and how much. Make sure that for each contract X, Y, that you use that you specify whether you are using it for lending or borrowing and for how much, and in what currency. You do not need to report the magnitude of the profit. 4) (This question is from the 2016 Winter Final Exam. As long as you attempt all parts you will receive full credit.) Today is t = 0. . . The price of a Dollar denominated 10-year zero coupon bond with Face Value = $10,000 is $8,000 r0,5 = 2% (Dollar interest rate); f20,5 = 3% (Dollar forward interest rate) fE20,5 = 4% (Euro forward interest rate) Contract X: for every $1 you give the bank at t = 10 they give you back 2 Euros at t = 20 o (or for every $1 you borrow at t = 10 you have to pay back 2 Euros at t = 20) Contract Y: for every $1 you give the bank at t = 0 they give you back K Euros at t = 25 o (or for every $1 you borrow at t = 0 you have to pay back K Euros at t = 25) Note: for a given currency, a forward interest rate in that currency allows you to lock in a lending or borrowing rate for that currency for a certain period of time. a) Assuming there is no arbitrage, write down one equation where the only unknown is K? You do not need to solve or isolate for K. b) Suppose K were 2 less than implied by your answer to part a. Describe how you would construct an arbitrage where you realize the profit (in Euros) at t = 25. Assume that your arbitrage involves buying or shorting 3 units of the 10-year zero coupon bond. Make sure that for each rate you are using you specify if you are borrowing or lending, in what currency, and how much. Make sure that for each contract X, Y, that you use that you specify whether you are using it for lending or borrowing and for how much, and in what currency. You do not need to report the magnitude of the profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts