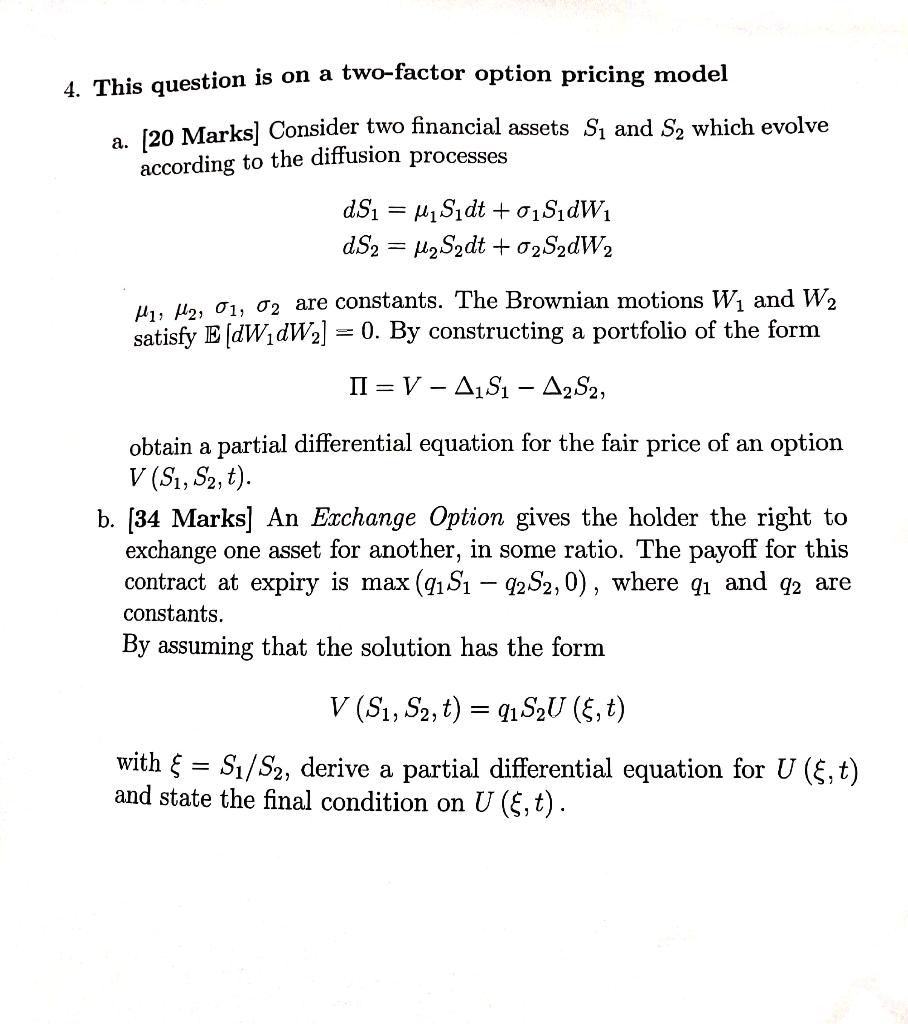

Question: 4. This question is on a two-factor option pricing model a. [20 Marks] Consider two financial assets S and S which evolve according to the

4. This question is on a two-factor option pricing model a. [20 Marks] Consider two financial assets S and S which evolve according to the diffusion processes dSMSidt + 0 SdW dS2 MSdt + 02S2dW2 - H, H2, 01, 02 are constants. The Brownian motions W and W satisfy E [dWidW] = 0. By constructing a portfolio of the form II = V - AS - A2S2, obtain a partial differential equation for the fair price of an option V (S, S2, t). b. [34 Marks] An Exchange Option gives the holder the right to exchange one asset for another, in some ratio. The payoff for this contract at expiry is max (91S - 92S2, 0), where 9 and 92 are constants. By assuming that the solution has the form V (S1, S2, t) = 91 SU (, t) with = S/S2, derive a partial differential equation for U (, t) and state the final condition on U (, t). 4. This question is on a two-factor option pricing model a. [20 Marks] Consider two financial assets S and S which evolve according to the diffusion processes dSMSidt + 0 SdW dS2 MSdt + 02S2dW2 - H, H2, 01, 02 are constants. The Brownian motions W and W satisfy E [dWidW] = 0. By constructing a portfolio of the form II = V - AS - A2S2, obtain a partial differential equation for the fair price of an option V (S, S2, t). b. [34 Marks] An Exchange Option gives the holder the right to exchange one asset for another, in some ratio. The payoff for this contract at expiry is max (91S - 92S2, 0), where 9 and 92 are constants. By assuming that the solution has the form V (S1, S2, t) = 91 SU (, t) with = S/S2, derive a partial differential equation for U (, t) and state the final condition on U (, t)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts