Question: 4. This question will guide you to solve the Merton problem with T = oo and u(c, t) = e pt In c. There are

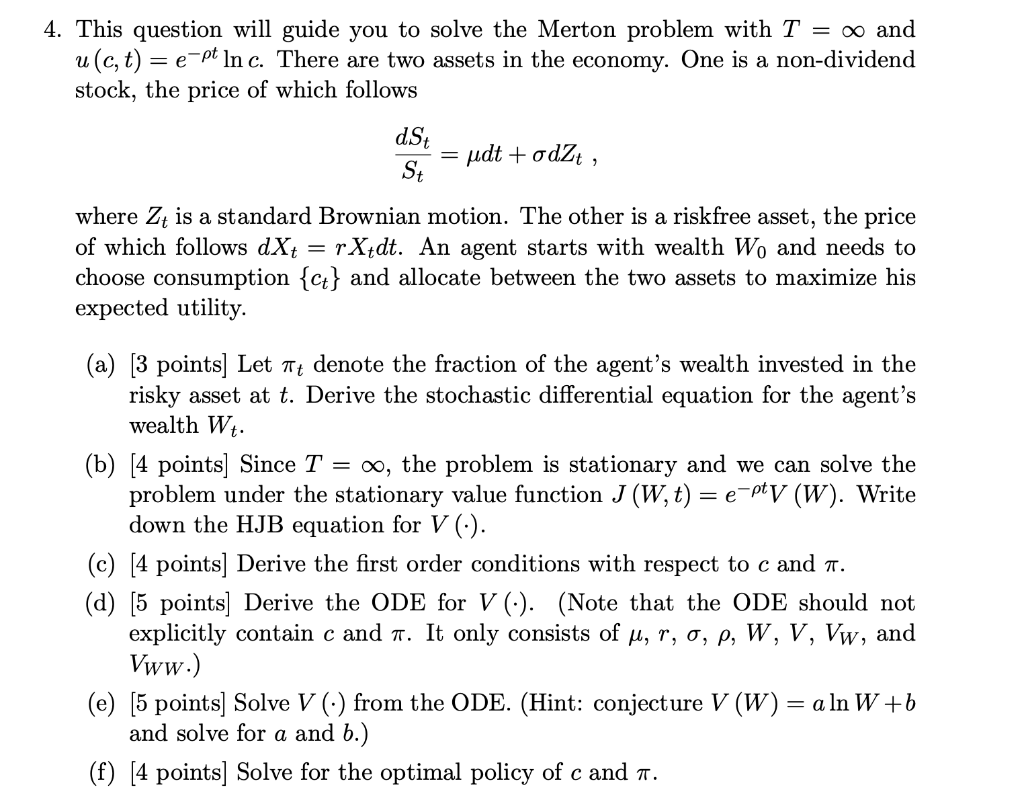

4. This question will guide you to solve the Merton problem with T = oo and u(c, t) = e pt In c. There are two assets in the economy. One is a non-dividend stock, the price of which follows dSt = udt + odZt, St where Zt is a standard Brownian motion. The other is a riskfree asset, the price of which follows dXt rX+dt. An agent starts with wealth Wo and needs to choose consumption {ct} and allocate between the two assets to maximize his expected utility = (a) [3 points) Let 74 denote the fraction of the agent's wealth invested in the risky asset at t. Derive the stochastic differential equation for the agent's wealth Wt. (b) [4 points] Since T = 0, the problem is stationary and we can solve the problem under the stationary value function J (W,t)= e-pty (W). Write down the HJB equation for V (.). (c) (4 points] Derive the first order conditions with respect to c and 77. (d) [5 points] Derive the ODE for V (). (Note that the ODE should not explicitly contain c and 7. It only consists of p, r, o, p, W, V, Vw, and Vww.) (e) [5 points] Solve V (.) from the ODE. (Hint: conjecture V (W) = a In W+b and solve for a and b.) (f) [4 points] Solve for the optimal policy of c and 7. 4. This question will guide you to solve the Merton problem with T = oo and u(c, t) = e pt In c. There are two assets in the economy. One is a non-dividend stock, the price of which follows dSt = udt + odZt, St where Zt is a standard Brownian motion. The other is a riskfree asset, the price of which follows dXt rX+dt. An agent starts with wealth Wo and needs to choose consumption {ct} and allocate between the two assets to maximize his expected utility = (a) [3 points) Let 74 denote the fraction of the agent's wealth invested in the risky asset at t. Derive the stochastic differential equation for the agent's wealth Wt. (b) [4 points] Since T = 0, the problem is stationary and we can solve the problem under the stationary value function J (W,t)= e-pty (W). Write down the HJB equation for V (.). (c) (4 points] Derive the first order conditions with respect to c and 77. (d) [5 points] Derive the ODE for V (). (Note that the ODE should not explicitly contain c and 7. It only consists of p, r, o, p, W, V, Vw, and Vww.) (e) [5 points] Solve V (.) from the ODE. (Hint: conjecture V (W) = a In W+b and solve for a and b.) (f) [4 points] Solve for the optimal policy of c and 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts