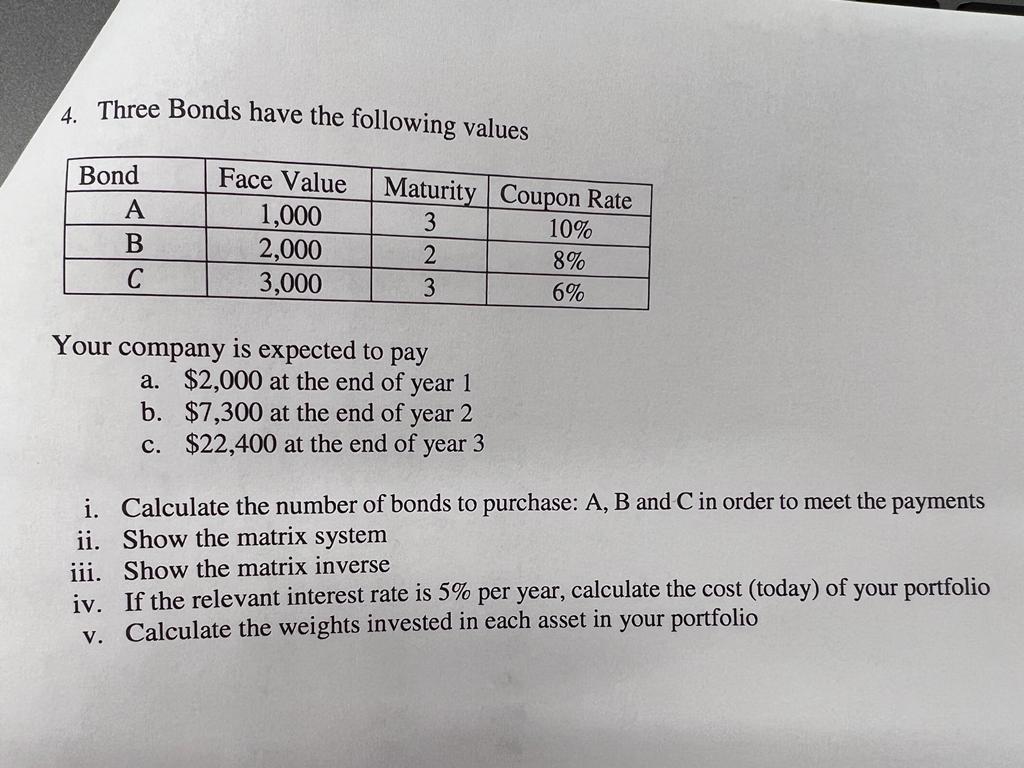

Question: 4. Three Bonds have the following values Bond Face Value Maturity Coupon Rate A 1,000 3 10% B 2,000 2 8% C 3,000 3

4. Three Bonds have the following values Bond Face Value Maturity Coupon Rate A 1,000 3 10% B 2,000 2 8% C 3,000 3 6% Your company is expected to pay a. $2,000 at the end of year 1 b. $7,300 at the end of year 2 c. $22,400 at the end of year 3 i. Calculate the number of bonds to purchase: A, B and C in order to meet the payments ii. Show the matrix system iii. Show the matrix inverse iv. If the relevant interest rate is 5% per year, calculate the cost (today) of your portfolio v. Calculate the weights invested in each asset in your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts