Question: 4. Three years ago, the fim purchased a machine for a three-year project. The machine is being depreciated straight-line to zero over a five-year period.

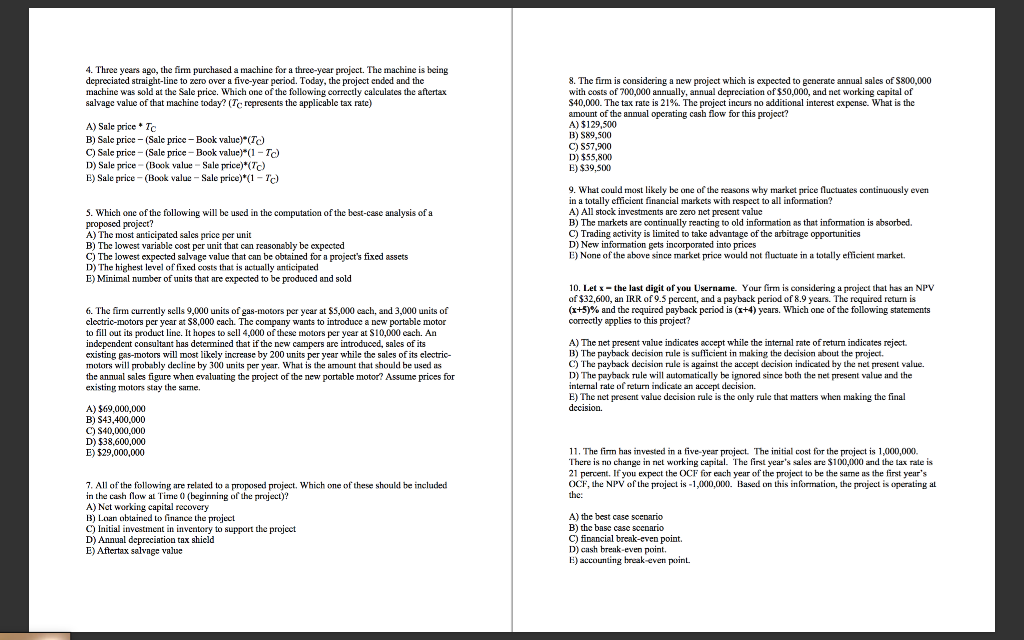

4. Three years ago, the fim purchased a machine for a three-year project. The machine is being depreciated straight-line to zero over a five-year period. Today, the project ended and the machine was sold at the sale price. Which one of the following correctly calculates the aftertax salvage value of that machine today? (Te represents the applicable tax rate) A) Sale price. To B) Sale price - (Sale price Book value)" (TO C) Sale price - (Sale price - Book value)*(1 -TC) D) Sale price - (Book value - Sale price)*(T) E) Sale price -(Book value - Sale price)*(1 - Tc) 8. The firm is considering a new project which is expected to generate annual sales of $800,000 with costs of 700,000 annually, annual depreciation of $50,000, and networking capital of $40,000. The tax rate is 21%. The project incurs no additional interest expense. What is the amount of the annual operating cash flow for this project? A) $129.500 B) 589,500 C) 557,900 D) $55,800 E) $39.500 5. Which one of the following will be used in the computation of the best-casc analysis of a proposed project? A) The most anticipated sales price per unit B) The lowest variable cost per unit that can reasonably be expected C) The lowest expected salvage value that can be obtained for a project's fixed assets D) The highest level of fixed osts that is actually anticipated E) Minimal number of units that are expected to be produced and sold 9. What could most likely be one of the reasons why market price fluctuates continuously even in a totally efficient financial markets with respect to all information? A) All stock investments are zero net present value B) The markets are continually reacting to old information as that information is absorbed. C) Trading activity is limited to take advantage of the arbitrage opportunities D) New information gets incorporated into prices E) None of the above since market price would not fluctuate in a totally efficient market. 6. The firm currently sells 9,000 units of gas-motors per year at $5,000 cach, and 3,000 units of cloctric-motors per year at $8,000 cach. The company wants to introduce a new portable motor to fill out its product line. It hopes to sell 4,000 of these motors per year at $10,000 each. An independent consultant has determined that if the new campers are introduced, sales of its existing gas-motors will most likely increase by 200 units per year while the sales of its electric- motors will probably decline by 300 units per year. What is the amount that should be used as the annual sales figure when evaluating the project of the new portable motor? Assume prices for existing motors stay the same. 10. Let the last digit of you Username. Your firm is considering a project that has an NPV of $32,600, an IRR of 9.5 percent, and a payback period of 8.9 years. The required return is (x+5)% and the required payback period is (x+4) years. Which one of the following statements correctly applies to this project? A) The net present value indicates accept while the internal rate of return indicates reject. 1) The payback decision rule is sufficient in making the decision about the project. C) The payback decision rule is against the accept decision indicated by the net present value. D) The payback rule will automatically be ignored since both the net present value and the internal rate of return indicate an accept decision. E) The net present value decision rule is the only rule that matters when making the final decision. A) $69,000,000 B) S43,400,000 C) $40,000,000 D) $38.600,000 E) 529,000,000 11. The finn has invested in a five-year project. The initial cost for the project is 1,000,000 There is no change in net working capital. The first year's sales are $100,000 and the tax rate is 21 percent. If you expect the OCF for each year of the project to be the same as the first year's OCF, the NPV of the project is -1,000,000. Based on this information, the project is operating al the: 7. All of the following are related to a proposed project. Which one of these should be included in the cash flow at Time (beginning of the project)? A) Networking capital recovery B) Loan obtained to finance the project C) Initial investment in inventory to support the project D) Annual depreciation tax shield E) Aftertax salvage value A) the best case scenario B) the base case scenario C) financial brenk-even point. D) cash break-even point. E) accounting break-even point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts