Question: 4. Tiny plc is a stable growth, publicly traded company, expected to grow 2% a year in perpetuity. It has a cost of equity of

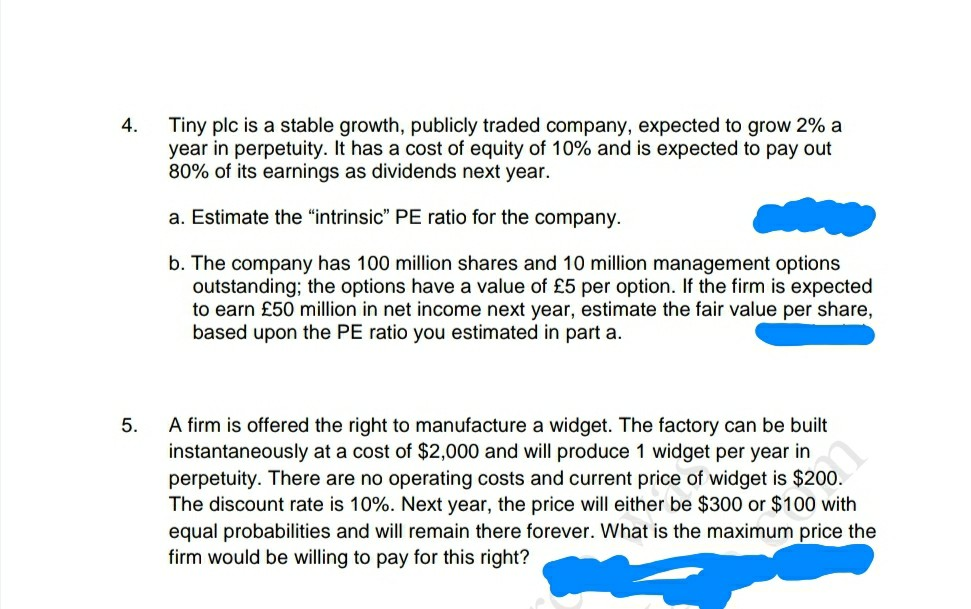

4. Tiny plc is a stable growth, publicly traded company, expected to grow 2% a year in perpetuity. It has a cost of equity of 10% and is expected to pay out 80% of its earnings as dividends next year. a. Estimate the "intrinsic" PE ratio for the company. b. The company has 100 million shares and 10 million management options outstanding; the options have a value of 5 per option. If the firm is expected to earn 50 million in net income next year, estimate the fair value per share, based upon the PE ratio you estimated in part a. 5. A firm is offered the right to manufacture a widget. The factory can be built instantaneously at a cost of $2,000 and will produce 1 widget per year in perpetuity. There are no operating costs and current price of widget is $200. The discount rate is 10%. Next year, the price will either be $300 or $100 with equal probabilities and will remain there forever. What is the maximum price the firm would be willing to pay for this right

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts