Question: ! 4-- TNormal1No Spac Heading 1 Heading 2 Title Paragraph Styles Chapter 3 Extra Credit 1. Jennifer Pontesso, from Lincoln, Nebraska, wants to better understand

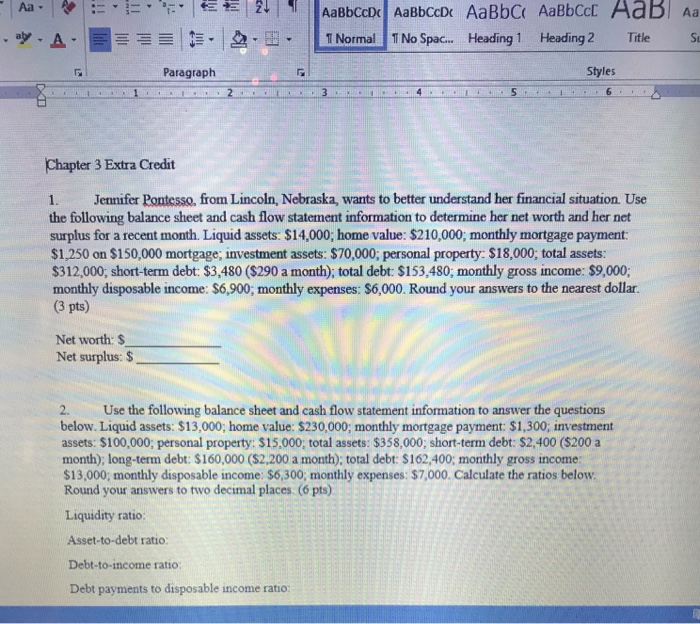

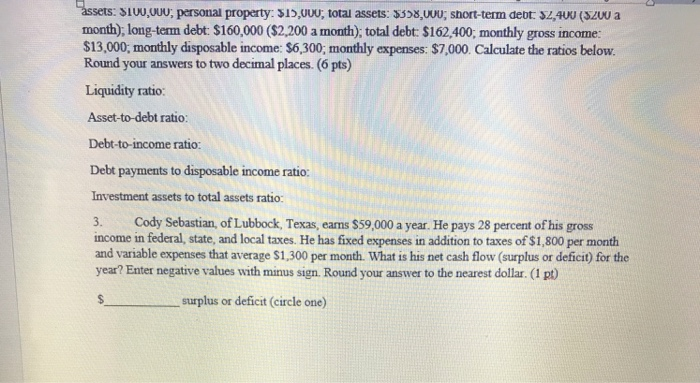

! 4-- TNormal1No Spac Heading 1 Heading 2 Title Paragraph Styles Chapter 3 Extra Credit 1. Jennifer Pontesso, from Lincoln, Nebraska, wants to better understand her financial situation. Use the following balance sheet and cash flow statement information to determine her net worth and her net surplus for a recent month. Liquid assets: $14,000; home value: $210,000, monthly mortgage payment $1,250 on $150,000 mortgage; investment assets: $70,000; personal property: $18,000, total assets: $312,000; short-term debt: $3,480 ($290 a month), total debt: $153,480, monthly gross income: $9,000 monthly disposable income: S6,900; monthly expenses: $6,000. Round your answers to the nearest dollar. (3 pts) Net worth: $ Net surplus: $ 2. Use the following balance sheet and cash flow statement information to answer the questions below. Liquid assets: $13,000, home value: $230,000; monthly mortgage payment: $1,300, investment assets: $100,000, personal property: $15,000; total assets: $358,000; short-term debt: $2,400 (S200 a month); long-term debt: $160,000 ($2,200 a month); total debt: $162,400; monthly gross income: $13,000, monthly disposable income: $6,300, monthly expenses: $7,000. Calculate the ratios below Round your answers to two decimal places. (6 pts) Liquidity ratio Asset-to-debt ratio Debt-to-income ratio Debt payments to disposable income ratio: assets: siU,ouu, personal property: S15,u00, total assets: 5358,UUU; short-term debt: 52,400 (S200 a month); long-term debt: $160,000 ($2,200 a month), total debt: $162,400, monthly gross income: $13,000, monthly disposable income: $6,300, monthly expenses: $7,000. Calculate the ratios below Round your answers to two decimal places. (6 pts) Liquidity ratio Asset-to-debt ratio Debt-to-income ratio Debt payments to disposable income ratio: Investment assets to total assets ratio: 3. Cody Sebastian, of Lubbock, Texas, eams $59,000 a year. He pays 28 percent of his gross income in federal, state, and local taxes. He has fixed expenses in addition to taxes of $1,800 per month and variable expenses that average $1,300 per month. What is his net cash flow (surplus or deficit) for the year? Enter negative values with minus sign. Round your answer to the nearest dollar. (1 p) s_ surplus or deficit (circle one)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts