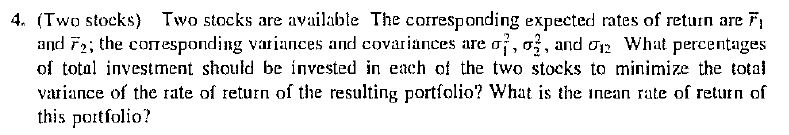

Question: 4. (Two stocks) Two stocks are available The corresponding expected rates of return are FI and F2i the corresponding variances and covariances are ??,?, and

4. (Two stocks) Two stocks are available The corresponding expected rates of return are FI and F2i the corresponding variances and covariances are ??,?, and ??2 What percentages ol total investment should be invested in each of the two stocks to minimize the total variance of the rate of return of the resulting portolio? What is the inean rate of return of this portfolio? 4. (Two stocks) Two stocks are available The corresponding expected rates of return are FI and F2i the corresponding variances and covariances are ??,?, and ??2 What percentages ol total investment should be invested in each of the two stocks to minimize the total variance of the rate of return of the resulting portolio? What is the inean rate of return of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts