Question: 4. Use the below table for all questions. a Ed Walker wants to save some money so that he can make a down payment of

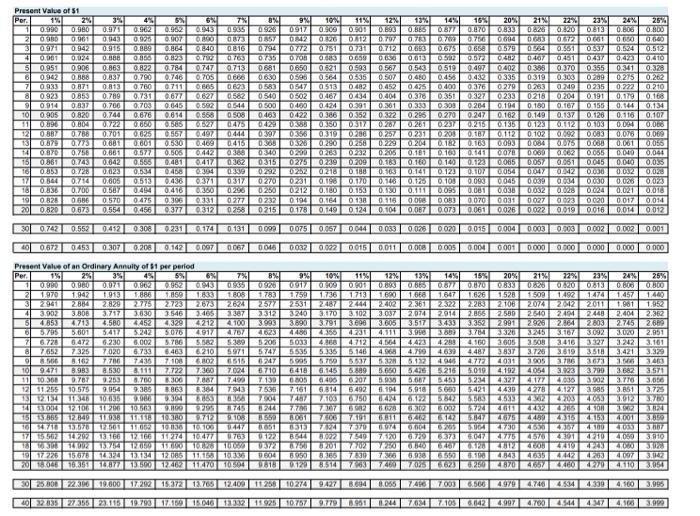

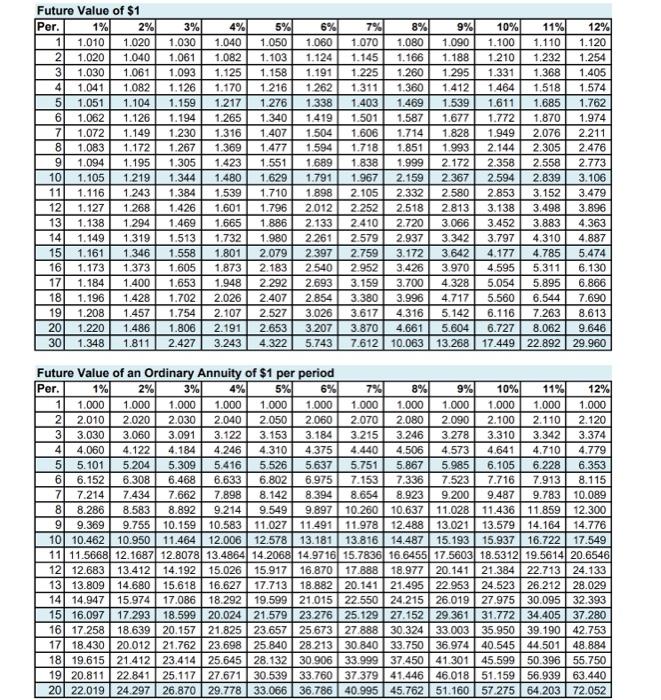

4. Use the below table for all questions.

a Ed Walker wants to save some money so that he can make a down payment of $3,000 on a car when he graduates from college in 4 years. If Ed opens a savings account and earns 3% on his money, compounded annually, how much will he have to invest now?

b Kristen Quinn makes equal deposits of $500 semiannually for 4 years. What is the future value at 8%?

Chuck Russo, a high school math teacher, wants to set up an IRA account into which he will deposit $2,000 per year. He plans to teach for 20 more years and then retire. If the interest on his account is 7% compounded annually, how much will be in his account when he retires?

dLarson Lumber makes annual deposits of $500 at 6% compounded annually for 3 years. What is the future value of these deposits?

Present Value of $1 Per. 2% 6% 3% 0.971 4% 0.962 5% 4.962 7% 0.935 8% 9% 10% 11% 0.926 0917 0.909 0.901 0.943 12% 13% 14% 16% 20% 21% 22% 23% 24% 25% 0.990 0.980 0.603 0.865 0.877 0.870 0.833 0.826 0320 0.813 0.806 0.800 2 0.980 0.961 0.943 0.995 0.907 0.800 0873 0857 0842 0.826 0812 0.707 0.763 0.709 0.756 0604 0683 0672 0.661 0.650 0.640 3 0.971 0.942 0.915 0.889 0.864 0.840 0816 0.794 0.772 0.751 0.731 0.712 0.653 0.675 0.668 0.579 0.564 0.561 0.537 0.524 0.512 4 0.961 0.024 0.888 0.856 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.013 0.592 0.572 0.482 0.407 0451 0437 0.423 0.410 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0681 0.650 0621 0.593 0.567 0.543 0.519 0.497 0402 0385 0.370 0.355 0.341 0.328 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.335 0319 0.303 0209 0.275 0.262 7 0.933 0.871 0.813 0.760 0.711 0.665 0623 0.583 0547 0513 0.482 0.452 0.425 0.400 0.376 0.279 0263 0.249 0235 0.222 0.210 8 0.923 0.853 0.789 0.731 0.677 6.627 0.582 0540 0502 0.467 0.434 0.404 0.376 0.351 0.327 0233 0218 0.204 0.191 0.179 0.168 9 0.914 0.837 0.706 0.703 0.645 0.592 0544 0.500 0.400 0.424 0.391 0.361 0.333 0.308 0.264 0.194 0.180 0.167 0155 0.144 0.134 10 0.905 0.820 0.744 0.676 0.614 0.568 0508 0.463 0422 0.386 0.352 0.322 0.295 0.270 0.247 0.162 0.149 0.137 0.126 0.116 0.107 11 0.896 0.804 0.722 0.850 0.585 0.527 0475 0429 0388 0.350 0317 0.287 0.261 0237 0.215 0.135 0.123 0.112 0.103 0.004 0.066 12 0.887 0.788 0.701 0.625 0.557 0.497 0444 0397 0356 0.319 0.288 0.257 0.231 0.208 0.187 0.112 0.102 0.092 0.083 0.076 0.069 13 0.879 0.775 0.681 0.601 0.530 0.469 0415 0.368 0326 0.290 0.258 0.229 0.204 0.182 0.163 0.093 0.084 0975 0.068 0.061 0.056 14 0.870 0.758 0.661 0.577 0.506 6.442 0368 0340 0200 0.263 0232 0.205 0.181 0.163 0.141 0.078 0.009 0.062 0.055 0.040 0.044 15 0.861 0.743 0.642 0.566 0.481 0.417 0362 0315 0275 0239 0.209 0.163 0.160 0140 0.128 0.065 0.057 0.61 0.045 0.040 0.035 161 0.853 0.728 0.623 0.534 0.458 0.394 0339 0292 0252 0.218 0.188 0.163 0.141 0.123 0.107 0.054 0.047 0042 0.036 0.032 17 0.844 0.714 0.605 0.513 0.436 0.371 0317 0270 0231 0.198 0.170 0.146 0.125 0.10 0.093 0.045 0.039 0.034 0.030 0.026 0.023 18 0.836 0.700 0.587 0.494 0.416 0.360 0.296 0.250 0212 0.180 0.153 0.130 0.111 0.095 0.061 0.038 0.032 0.028 0.024 0.021 19 0.828 0.686 0570 0.475 0.306 0.331 0277 0232 0.194 0.164 0.138 0.116 0008 0.083 0.070 0031 0027 0.023 0020 0.017 20 0.820 0673 0.554 0.456 0.377 0312 0.258 0215 0.178 0.149 0.124 0.104 0.067 0.073 0.061 0026 0.022 0.019 0.016 0.014 0.028 0.018 0.014 0.012 30 0.742 0.001 0.552 0.412 0308 0174 0.131 0099 0075 0.067 0.033 0.011 0.025 0.020 0.015 0.004 0.008 0.005 0.004 0001 0.003 0.003 0.002 0.002 0.000 0.000 0.000 0.000 0.000 40 0672 0.453 0.307 0.208 0.142 0.097 0.067 0046 0.032 0.002 0.015 2 3 4 5 6 7 6.230 6.002 5.786 5.582 5.389 8 Present Value of an Ordinary Annuity of $1 per period Per. 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 20% 21% 22% 23% 24% 25% 0.990 0.980 0.971 0.962 0.982 0.943 0.935 0926 0917 0.909 0.901 0.893 0.865 0.877 0.870 0.833 0.826 0.620 0.813 0.806 0.800 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1,759 1.736 1713 1,690 1.668 1.647 1.626 1.528 1.509 1492 1.474 1.457 1440 2.941 2.884 2.829 2.775 2.723 2.673 2624 2577 2531 2487 2444 2.402 2.361 2.322 2.283 2.106 2074 2042 2011 1.961 1.952 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3312 3240 3.170 3.102 3.037 2.074 2.914 2.866 2.580 2.540 2.494 2.448 2.404 2.362 4.853 4.713 4.580 4.452 4.329 4212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 2.991 2.926 2.864 2803 2.745 2.689 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4623 4.486 4.356 4.231 4.111 3.998 3.889 3.784 3.326 3.245 3.167 3.092 3.020 2.951 6.728 6.472 5.200 5033 4.368 4.712 4.564 4.423 4.288 3.605 3.508 3.416 3.327 3:242 3.161 7.652 7.325 7.020 6.733 6.463 6.210 5971 5747 5.535 5.335 5.146 4.968 4.799 4.639 4.487 3.837 3.726 3.619 3518 3.421 3.329 9 8.506 8.162 7.706 7436 7.108 6.802 6515 6247 5.995 5.750 5.537 5.328 5.132 4.946 4.772 4031 3.905 3.786 3673 3.566 3.463 10 9.471 8.983 8.530 8.111 7.024 6710 6418 6.145 5.889 5.650 5.416 5.216 5.019 4.192 4.054 3.923 3.799 3.682 3.571 11 10.368 9.787 9.253 8.700 8.306 7.887 7.499 7.139 6805 6.400 6.207 5.935 5.667 5.453 5.234 4.327 4.177 4.000 3.902 3.776 3.006 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.650 5.421 4.439 4278 4.127 3.985 3.851 3.725 13 12.134 11.346 10.635 9.986 304 8.865 8368 7504 7487 7.103 6.750 6.424 6.122 5.842 5.563 4.533 4382 4203 4.053 3.012 3.780 14 $3.004 12.106 11.206 10.563 9.800 9.295 8.745 8244 7.706 7.367 6982 6.628 6.302 6.002 5.724 4611 4432 4265 4500 3.962 3.824 1513.865 12.849 11.938 11.458 10.380 9.712 9.108 8.559 8061 7.606 7.491 6.811 6462 6.142 5.847 4.675 4.489 4.315 4.153 4.001 3.859 16 14.716 13.578 12.501 11,002 10 850 10.100 9447 6.651 6313 7824 7379 6.974 6.604 6205 5.904 4730 4.530 4.367 4.100 4.033 3.887 17 15 562 14.292 13.166 12.166 11 274 10.477 0763 0122 8544 8.002 7.549 7.120 6.729 6.373 6.047 4.775 4576 4.301 4210 4,050 3.910 18 16 308 14.002 15.754 12.650 11.000 10.89610.000 9372 6.750 8201 7.702 7.250 6.840 6.467 6.128 4812 4608 4419 4243 4.000 3.9288 19 17 226 8.950 8.366 7430 7.366 6.938 6.550 6.100 4.843 4.635 4.442 4263 4.097 3.942 2018.046 0129 8514 7963 7.460 7.025 6623 6.250 4870 4.657 4.460 4.270 4.110 3.054 7.722 7.360 15.678 14.324 13.134 12.086 11.158 10.336 9.604 16.351 14.877 13.500 12.462 11.470 10504 9818 22.396 19.000 17.292 15.372 13.765 12.409 10274 8.055 4.160 3.995 30 25.808 7003 6.566 4.979 9427 6.694 9.779 8951 8.244 7.634 7.105 4.746 4.534 4.339 4.700 4544 4.347 4.100 3.999 40 32 835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 6.642 4.997 Future Value of $1 Per. 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 1 1.010 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.120 2 1.020 3 1.030 4 1.041 1.020 1.040 1.061 1.061 1.093 1.082 1.126 1.170 1.051 1.104 1.159 1.217 6 1.062 1.126 1.194 1.265 1.082 1.103 1.124 1.125 1.158 1.191 1.216 1.262 1.311 1.225 1.110 1.145 1.166 1.188 1.210 1.232 1.254 1.260 1.295 1.331 1.368 1.405 1.360 1.412 1.464 1.518 1.574 1.469 1.539 1.611 1.685 1.762 1.772 5 1.587 1.677 1.870 1.974 7 1.714 1.828 1.949 2.076 2.211 1.072 1.149 1.230 1.083 1.172 1.267 8 2.305 2.476 9 1.094 1.195 1.305 2.558 2.773 2.839 3.106 2.853 3.152 3.479 3.138 3.498 3.896 1.276 1.338 1.403 1.340 1.419 1.501 1.316 1.407 1.504 1.606 1.369 1.477 1.594 1.718 1.851 1.993 2.144 1.423 1.551 1.689 1.838 1.999 2.172 2.358 10 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 11 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 2.580 12 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 2.813 1.469 1.665 1.886 2.133 2.410 2.720 3.066 1.513 1.732 1.980 2.261 2.579 2.937 1.558 1.801 2.079 2.397 2.759 3.172 4.785 5.474 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 5.311 6.130 1.184 1.400 1.653 1.948 2.292 2.693 3.159 3.700 4.328 5.054 5.895 6.866 1.196 1.428 1.702 2.026 2.407 3.380 4.717 5.560 6.544 1.208 1.457 1.754 2.107 2.527 1.220 1.486 1.806 2.191 2.653 13 1.138 1.294 3.452 3.883 4.363 1.149 1.319 3.342 3.797 4.310 4.887 14 15 1.161 1.346 3.642 4.177 16 17 18 2.854 7.690 3.996 3.617 4.316 19 5.142 6.116 7.263 8.613 3.026 3.207 20 3.870 4.661 5.604 6.727 8.062 9.646 7.612 10.063 13.268 17.449 22.892 29.960 30 1.348 1.811 2.427 3.243 4.322 5.743 Future Value of an Ordinary Annuity of $1 per period Per. 1% 2% 3% 4% 5% 6% 9% 10% 11% 12% 1.000 1.000 1.000 1.000 2.120 3.374 4.779 6.353 7 8 9 7% 8% 1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.110 3 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.342 4 4.060 4.122 4.184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 4.710 5 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.228 6 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7,336 7.523 7.716 7.913 8.115 7.214 7.434 7.662 7,898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 10.089 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.637 11.028 11.436 11.859 12.300 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13.021 13.579 14.164 14.776 10 10.462 10.950 11.464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 17.549 11 11.5668 12.1687 12.8078 13.4864 14.2068 14.9716 15.7836 16.6455 17.5603 18.5312 19.5614 20.6546 12 12.683 13.412 14.192 15.026 15.917 16.870 17.888 18.977 20.141 21.384 22.713 24.133 13 13.809 14.680 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 28.029 14 14.947 15.974 17.086 18.292 19.599 21.015 22.550 24.215 26.019 27.975 30.095 32.393 15 16.097 17.293 18.599 20.024 21.579 23.276 25.129 27.152 29.361 31.772 34.405 37.280 16 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39.190 42.753 17 18.430 20.012 21.762 23.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 48.884 18 19.615 21.412 23.414 25.645 28.132 30.906 33.999 37.450 41.301 45.599 50.396 55.750 19 20.811 22.841 25.117 27.671 30.539 33.760 37.379 41.446 46.018 51.159 56.939 63.440 20 22.019 24.297 26.870 29.778 33.066 36.786 40.995 45.762 51.160 57.275 64.203 72.052 20 89 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts