Question: (4) Use the Black-Scholes methodology to find, by direct calculation, an explicit formula for the fair price (at time of the following contingent claim (European

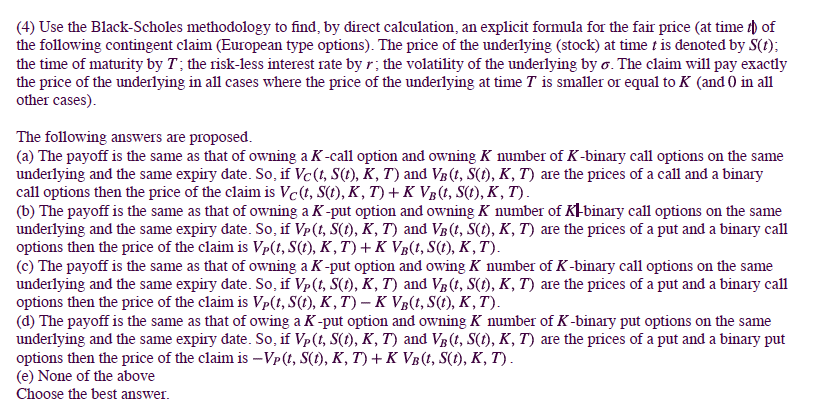

(4) Use the Black-Scholes methodology to find, by direct calculation, an explicit formula for the fair price (at time of the following contingent claim (European type options). The price of the underlying (stock) at time t is denoted by S(t); the time of maturity by T; the risk-less interest rate by r; the volatility of the underlying by o. The claim will pay exactly the price of the underlying in all cases where the price of the underlying at time T is smaller or equal to K (and 0 in all other cases). The following answers are proposed. (a) The payoff is the same as that of owning a K-call option and owning K number of K-binary call options on the same underlying and the same expiry date. So, if Vc(t, S(O), K, T) and Vet, S(1), K, T) are the prices of a call and a binary call options then the price of the claim is Vc(t, S(t), K, T) +K VB(t, S(O), K, T). (b) The payoff is the same as that of owning a K-put option and owning K number of kl-binary call options on the same underlying and the same expiry date. So, if Vp(t, S(1), K, T) and Ve(t, S(1), K, T) are the prices of a put and a binary call options then the price of the claim is Vp(t, S(1), K, T) + K VAT, SO), K, T). (c) The payoff is the same as that of owning a K-put option and owing K number of K-binary call options on the same underlying and the same expiry date. So, if Vp(t, S(1), K, T) and Velt, S(1), K, T) are the prices of a put and a binary call options then the price of the claim is Vp(t, S(1), K, T) - K VAT, SO), K, T). (d) The payoff is the same as that of owing a K-put option and owning K number of K-binary put options on the same underlying and the same expiry date. So, if Vp(t, S(O), K, T) and Ve(t, S(1), K, T) are the prices of a put and a binary put options then the price of the claim is -Vpt, S(1), K, T) + K Vet, S(1), K, T). (e) None of the above Choose the best answer. (4) Use the Black-Scholes methodology to find, by direct calculation, an explicit formula for the fair price (at time of the following contingent claim (European type options). The price of the underlying (stock) at time t is denoted by S(t); the time of maturity by T; the risk-less interest rate by r; the volatility of the underlying by o. The claim will pay exactly the price of the underlying in all cases where the price of the underlying at time T is smaller or equal to K (and 0 in all other cases). The following answers are proposed. (a) The payoff is the same as that of owning a K-call option and owning K number of K-binary call options on the same underlying and the same expiry date. So, if Vc(t, S(O), K, T) and Vet, S(1), K, T) are the prices of a call and a binary call options then the price of the claim is Vc(t, S(t), K, T) +K VB(t, S(O), K, T). (b) The payoff is the same as that of owning a K-put option and owning K number of kl-binary call options on the same underlying and the same expiry date. So, if Vp(t, S(1), K, T) and Ve(t, S(1), K, T) are the prices of a put and a binary call options then the price of the claim is Vp(t, S(1), K, T) + K VAT, SO), K, T). (c) The payoff is the same as that of owning a K-put option and owing K number of K-binary call options on the same underlying and the same expiry date. So, if Vp(t, S(1), K, T) and Velt, S(1), K, T) are the prices of a put and a binary call options then the price of the claim is Vp(t, S(1), K, T) - K VAT, SO), K, T). (d) The payoff is the same as that of owing a K-put option and owning K number of K-binary put options on the same underlying and the same expiry date. So, if Vp(t, S(O), K, T) and Ve(t, S(1), K, T) are the prices of a put and a binary put options then the price of the claim is -Vpt, S(1), K, T) + K Vet, S(1), K, T). (e) None of the above Choose the best

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts