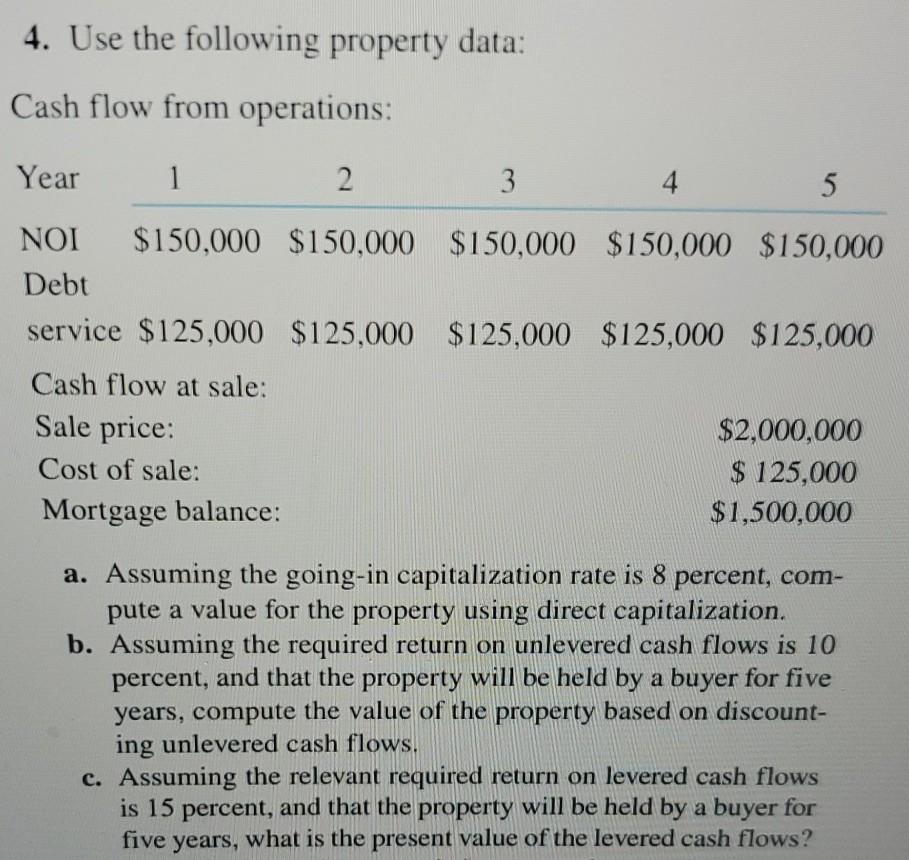

Question: 4. Use the following property data: Cash flow from operations: Year 1 2 3 4 5 NOI $150,000 $150,000 $150,000 $150,000 $150,000 Debt service $125,000

4. Use the following property data: Cash flow from operations: Year 1 2 3 4 5 NOI $150,000 $150,000 $150,000 $150,000 $150,000 Debt service $125,000 $125,000 $125,000 $125,000 $125,000 Cash flow at sale: Sale price: $2,000,000 Cost of sale: $ 125,000 Mortgage balance: $1,500,000 a. Assuming the going-in capitalization rate is 8 percent, com- pute a value for the property using direct capitalization. b. Assuming the required return on unlevered cash flows is 10 percent, and that the property will be held by a buyer for five years, compute the value of the property based on discount- ing unlevered cash flows. c. Assuming the relevant required return on levered cash flows is 15 percent, and that the property will be held by a buyer for five years, what is the present value of the levered cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts