Question: 4. Using Excel or your favorite software: {a} A 5year Treasury newly issued on August 15, 2021 would have a coupon equal to the 5year

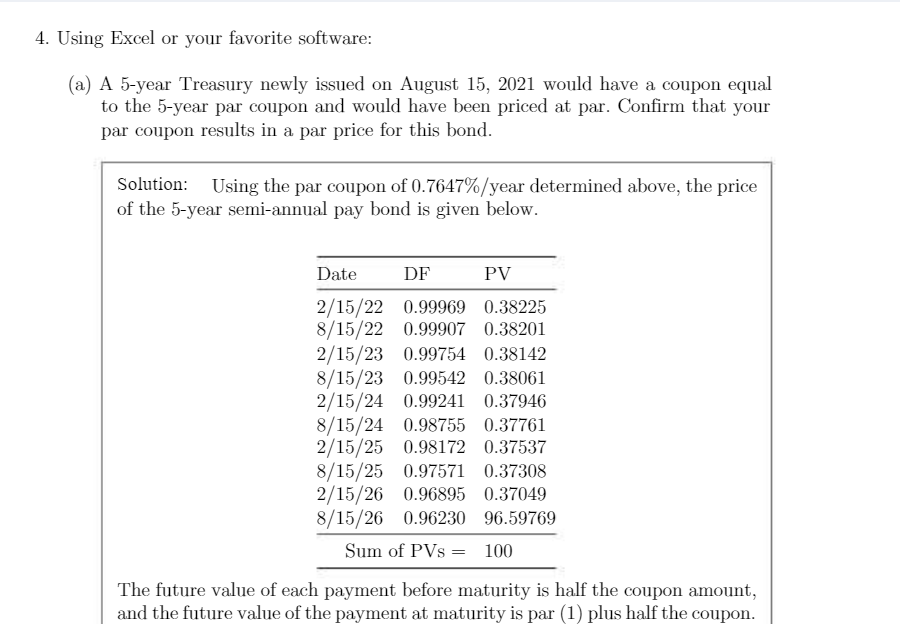

4. Using Excel or your favorite software: {a} A 5year Treasury newly issued on August 15, 2021 would have a coupon equal to the 5year par coupon and would have been priced at par. Conrm that your par coupon results in a par price for this bond. 3011100115 Using the par coupon of 0.704793 /' year determined ahove, the price of the 5year semiannual pay bond is given helow. Date 2/15/22 5/15/22 2/15/23 5/15/23 2/15/24 5/15/24 2/15/25 5/15/25 2/15/25 5/15/25 DF 0.99909 0.99907 0.99754 0.99542 0.99241 0.98755 0.98172 0.97571 0.90895 0.90230 Sum of PVs = P1? 0.38225 0.38201 0.38142 0.38001 0.37940 0.37701 0.37537 0.37308 0.37049 90.59709 100 The future value of each payment hefore maturity is half the coupon amount, and the future value of the payment at maturity is par {1) plus half the coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts