Question: 4) USING THE BAUMOL MODEL, CALCULATE THE FOLLOWING GIVEN A SHORT-TERM INVESTMENT RATE (1) OF 3%, $75 TRANSACTION COSTS (F), AND ANNUAL CASH DISBURSEMENTS (TCN)

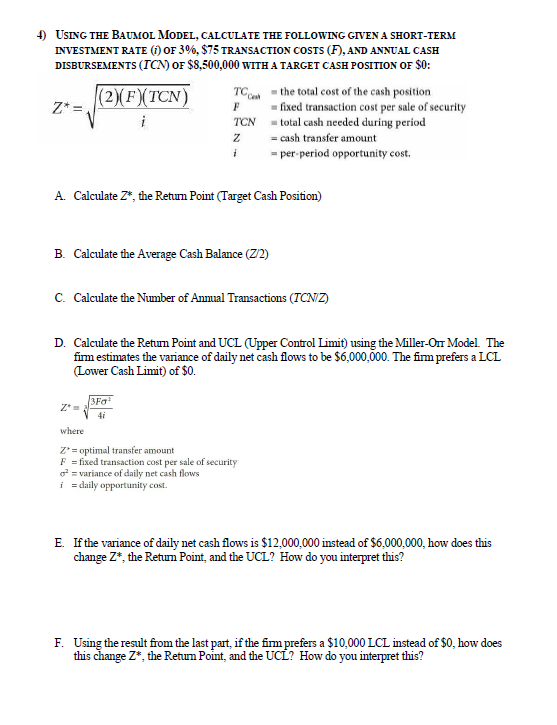

4) USING THE BAUMOL MODEL, CALCULATE THE FOLLOWING GIVEN A SHORT-TERM INVESTMENT RATE (1) OF 3%, $75 TRANSACTION COSTS (F), AND ANNUAL CASH DISBURSEMENTS (TCN) OF $8,500,000 WITH A TARGET CASH POSITION OF $0: (2)(F)(TCN) TCC = the total cost of the cash position Z= = fixed transaction cost per sale of security i TCN total cash needed during period = cash transfer amount -per-period opportunity cost F Z 1 A. Calculate 2*, the Retur Point (Target Cash Position) B. Calculate the Average Cash Balance (2/2) C. Calculate the Number of Anmual Transactions (TCNIZ) D. Calculate the Return Point and UCL (Upper Control Limit) using the Miller-On Model. The fim estimates the variance of daily net cash flows to be $6,000,000. The fim prefers a LCL (Lower Cash Limit) of $0. 3F Z = 41 where Z* = optimal transfer amount F = fixed transaction cost per sale of security c = variance of daily net cash flows i = daily opportunity cost. E. If the variance of daily net cash flows is $12,000,000 instead of $6,000,000, how does this change Z*, the Return Point, and the UCL? How do you interpret this? F. Using the result from the last part, if the fimm prefers a $10,000 LCL instead of $0, how does this change Z*, the Return Point, and the UCL? How do you interpret this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts