Question: 4. Using the methodology outlined in Exhibit 11.12 and 11.13, forecast the financing items on next years balance sheet for PartsCo. Assume short-term debt remains

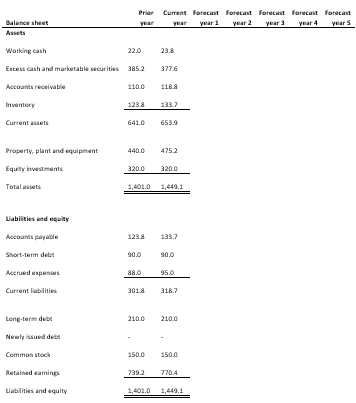

4. Using the methodology outlined in Exhibit 11.12 and 11.13, forecast the financing items on next years balance sheet for PartsCo. Assume short-term debt remains at $90 million, longterm debt remains at $210 million, no equity is raised, and the firm maintains the same dividend payout ratio as the current year. Use either newly issued debt or excess cash and marketable securities as the funding plug to balance the balance sheet. Your forecast should be consistent with forecasts in Questions 2 and 3.

Prior Current forecast forecast forecast forecast forecast Balance sheet year year 1 year 2 years year 4 years Assets Working cash 22.0 23.8 Excess cash and marketable securities 3852 377.6 Accounts receivable 110.0 118. Inventory 1238 133.7 Current assets 6410 653,9 440.0 4752 Property, plant and equipment Equity investments Totales 3200 320.0 1,401.01,440.1 123.8 133.7 Liabilities and equity Accounts payable Short-term debet Accrued expenses Current liabilities 90.0 90.0 95.0 2018 318.7 210.0 210.0 Long-term der Newly issued debt Common stock Retained earnings Liabilities and equity 150.0 150.0 7392 770.4 1,401.0 1,449.1 Prior Current forecast forecast forecast forecast forecast Balance sheet year year 1 year 2 years year 4 years Assets Working cash 22.0 23.8 Excess cash and marketable securities 3852 377.6 Accounts receivable 110.0 118. Inventory 1238 133.7 Current assets 6410 653,9 440.0 4752 Property, plant and equipment Equity investments Totales 3200 320.0 1,401.01,440.1 123.8 133.7 Liabilities and equity Accounts payable Short-term debet Accrued expenses Current liabilities 90.0 90.0 95.0 2018 318.7 210.0 210.0 Long-term der Newly issued debt Common stock Retained earnings Liabilities and equity 150.0 150.0 7392 770.4 1,401.0 1,449.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts