Question: 4. Using the quotations in Exhibit 7.3, note that the June 2019 Mexican peso futures contract has a price of $0.05143 per MXN. You believe

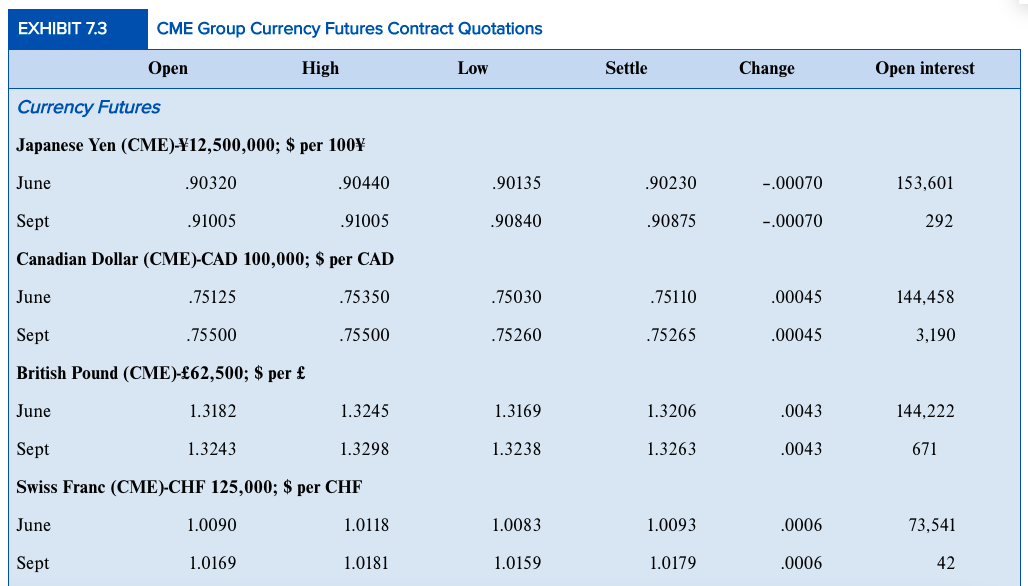

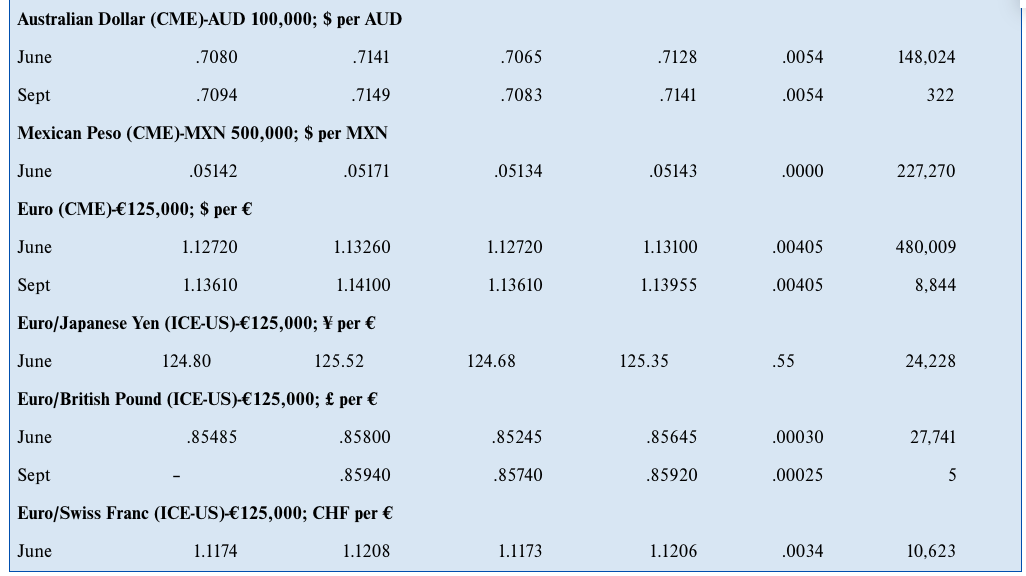

4. Using the quotations in Exhibit 7.3, note that the June 2019 Mexican peso futures contract has a price of $0.05143 per MXN. You believe the spot price in June will be 0.05795 per MXN. What speculative position would you enter into to attempt to profit from your beliefs? Calculate your anticipated profits, assuming you take a position in three contracts. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes? 5. Do problem 4 again assuming you believe the June 2019 spot price will be $0.04491 per MXN. EXHIBIT 7.3 CME Group Currency Futures Contract Quotations Open High Low Settle Change Open interest Currency Futures Japanese Yen (CME)-12,500,000; $ per 100 June .90320 .90440 .90135 .90230 -.00070 153,601 Sept 91005 91005 90840 90875 -.00070 292 Canadian Dollar (CME)-CAD 100,000; $ per CAD June .75125 .75350 .75030 .75110 .00045 144,458 Sept .75500 .75500 .75260 .75265 .00045 3,190 British Pound (CME)-62,500; $ per June 1.3182 1.3245 1.3169 1.3206 .0043 144,222 Sept 1.3243 1.3298 1.3238 1.3263 .0043 671 Swiss Franc (CME)-CHF 125,000; $ per CHF June 1.0090 1.0118 1.0083 1.0093 .0006 73,541 Sept 1.0169 1.0181 1.0159 1.0179 .0006 42 Australian Dollar (CME)-AUD 100,000; $ per AUD June .7080 .7141 .7065 .7128 .0054 148,024 Sept .7094 .7149 .7083 .7141 .0054 322 Mexican Peso (CME)-MXN 500,000; $ per MXN June .05142 .05171 .05134 .05143 .0000 227,270 Euro (CME)-125,000; $ per June 1.12720 1.13260 1.12720 1.13100 .00405 480,009 Sept 1.13610 1.14100 1.13610 1.13955 .00405 8,844 Euro/Japanese Yen (ICE-US)-125,000; per June 124.80 125.52 124.68 125.35 .55 24,228 Euro/British Pound (ICE-US)-125,000; per June .85485 .85800 .85245 .85645 .00030 27,741 Sept .85940 .85740 .85920 .00025 5 Euro/Swiss Franc (ICE-US)-125,000; CHF per June 1.1174 1.1208 1.1173 1.1206 .0034 10,623 4. Using the quotations in Exhibit 7.3, note that the June 2019 Mexican peso futures contract has a price of $0.05143 per MXN. You believe the spot price in June will be 0.05795 per MXN. What speculative position would you enter into to attempt to profit from your beliefs? Calculate your anticipated profits, assuming you take a position in three contracts. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes? 5. Do problem 4 again assuming you believe the June 2019 spot price will be $0.04491 per MXN. EXHIBIT 7.3 CME Group Currency Futures Contract Quotations Open High Low Settle Change Open interest Currency Futures Japanese Yen (CME)-12,500,000; $ per 100 June .90320 .90440 .90135 .90230 -.00070 153,601 Sept 91005 91005 90840 90875 -.00070 292 Canadian Dollar (CME)-CAD 100,000; $ per CAD June .75125 .75350 .75030 .75110 .00045 144,458 Sept .75500 .75500 .75260 .75265 .00045 3,190 British Pound (CME)-62,500; $ per June 1.3182 1.3245 1.3169 1.3206 .0043 144,222 Sept 1.3243 1.3298 1.3238 1.3263 .0043 671 Swiss Franc (CME)-CHF 125,000; $ per CHF June 1.0090 1.0118 1.0083 1.0093 .0006 73,541 Sept 1.0169 1.0181 1.0159 1.0179 .0006 42 Australian Dollar (CME)-AUD 100,000; $ per AUD June .7080 .7141 .7065 .7128 .0054 148,024 Sept .7094 .7149 .7083 .7141 .0054 322 Mexican Peso (CME)-MXN 500,000; $ per MXN June .05142 .05171 .05134 .05143 .0000 227,270 Euro (CME)-125,000; $ per June 1.12720 1.13260 1.12720 1.13100 .00405 480,009 Sept 1.13610 1.14100 1.13610 1.13955 .00405 8,844 Euro/Japanese Yen (ICE-US)-125,000; per June 124.80 125.52 124.68 125.35 .55 24,228 Euro/British Pound (ICE-US)-125,000; per June .85485 .85800 .85245 .85645 .00030 27,741 Sept .85940 .85740 .85920 .00025 5 Euro/Swiss Franc (ICE-US)-125,000; CHF per June 1.1174 1.1208 1.1173 1.1206 .0034 10,623

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts