Question: 4. Value: points 2.85 E9-12 Computing and Reporting the Acquisition and Amortization of Three Different Intangible Assets CLO 9-6] Bluestone Company had three intangible assets

![Amortization of Three Different Intangible Assets CLO 9-6] Bluestone Company had three](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e3043e67496_79066e3043e0a11c.jpg)

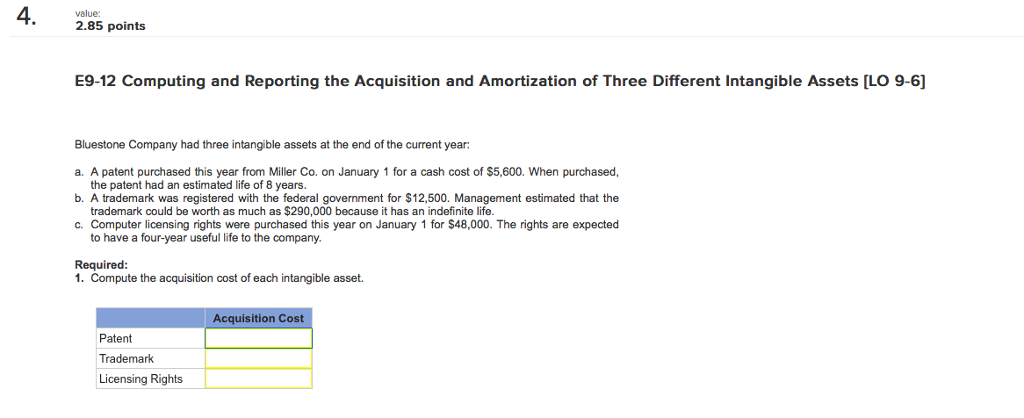

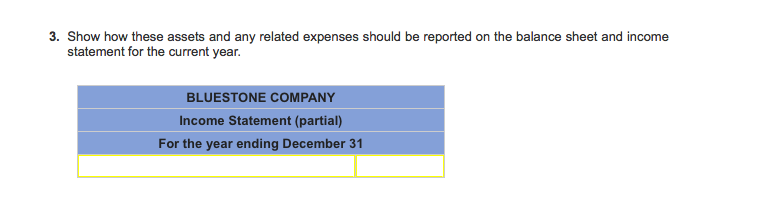

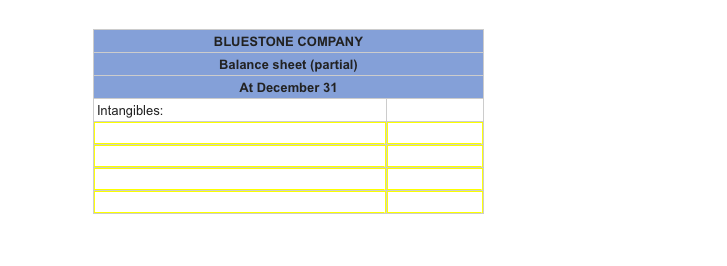

4. Value: points 2.85 E9-12 Computing and Reporting the Acquisition and Amortization of Three Different Intangible Assets CLO 9-6] Bluestone Company had three intangible assets at the end of the current year: a. A patent purchased this year from Miller Co. on January 1 for a cash cost of $5,600. When purchased, the patent had an estimated life of 8 years. b. A trademark was registered with the federal government for $12,500. Management estimated that the trademark could be worth as much as $290,000 because it has an indefinite life. c. Computer licensing rights were purchased this year on January 1 for $48,000. The rights are expected to have a four-year useful life to the company. Required: 1. Compute the acquisition cost of each intangible asset. Acquisition Cost Patent Trademark Licensing Rights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts