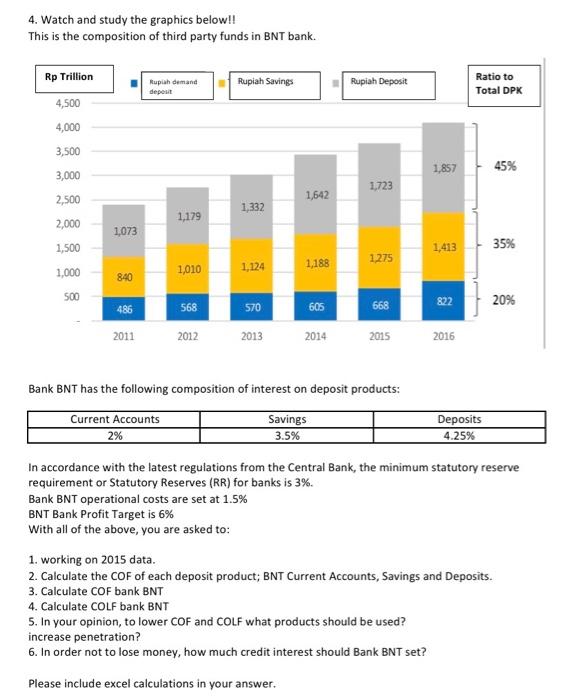

Question: 4. Watch and study the graphics below!! This is the composition of third party funds in BNT bank. Rp Trillion Ruplah demand deposit Rupiah Savings

4. Watch and study the graphics below!! This is the composition of third party funds in BNT bank. Rp Trillion Ruplah demand deposit Rupiah Savings Rupiah Deposit Ratio to Total DPK 4,500 4,000 3,500 1,857 45% 1,723 3,000 2,500 2,000 1,642 1,332 1,179 1,073 1,500 1,413 35% 1,275 1,000 1,010 1,188 1,124 840 500 486 822 20% 568 570 605 668 2011 2012 2013 2014 2015 2016 Bank BNT has the following composition of interest on deposit products: Current Accounts Savings 3.5% Deposits 4.25% 2% In accordance with the latest regulations from the Central Bank, the minimum statutory reserve requirement or Statutory Reserves (RR) for banks is 3%. Bank BNT operational costs are set at 1.5% BNT Bank Profit Target is 6% With all of the above, you are asked to: 1. working on 2015 data. 2. Calculate the CoF of each deposit product; BNT Current Accounts, Savings and Deposits. 3. Calculate COF bank BNT 4. Calculate COLF bank BNT 5. In your opinion, to lower CoF and COLF what products should be used? increase penetration? 6. In order not to lose money, how much credit interest should Bank BNT set? Please include excel calculations in your answer. 4. Watch and study the graphics below!! This is the composition of third party funds in BNT bank. Rp Trillion Ruplah demand deposit Rupiah Savings Rupiah Deposit Ratio to Total DPK 4,500 4,000 3,500 1,857 45% 1,723 3,000 2,500 2,000 1,642 1,332 1,179 1,073 1,500 1,413 35% 1,275 1,000 1,010 1,188 1,124 840 500 486 822 20% 568 570 605 668 2011 2012 2013 2014 2015 2016 Bank BNT has the following composition of interest on deposit products: Current Accounts Savings 3.5% Deposits 4.25% 2% In accordance with the latest regulations from the Central Bank, the minimum statutory reserve requirement or Statutory Reserves (RR) for banks is 3%. Bank BNT operational costs are set at 1.5% BNT Bank Profit Target is 6% With all of the above, you are asked to: 1. working on 2015 data. 2. Calculate the CoF of each deposit product; BNT Current Accounts, Savings and Deposits. 3. Calculate COF bank BNT 4. Calculate COLF bank BNT 5. In your opinion, to lower CoF and COLF what products should be used? increase penetration? 6. In order not to lose money, how much credit interest should Bank BNT set? Please include excel calculations in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts