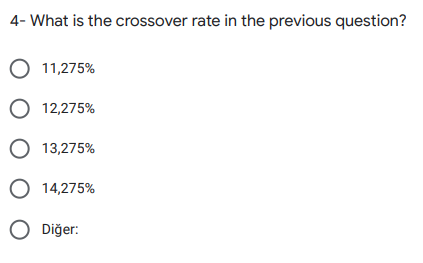

Question: 4- What is the crossover rate in the previous question? 11,275% O 12,275% O 13,275% O 14,275% O Dier: 5- Which one of the following

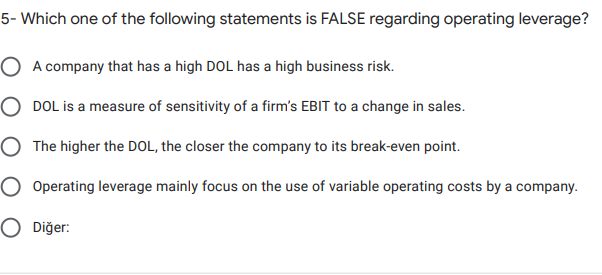

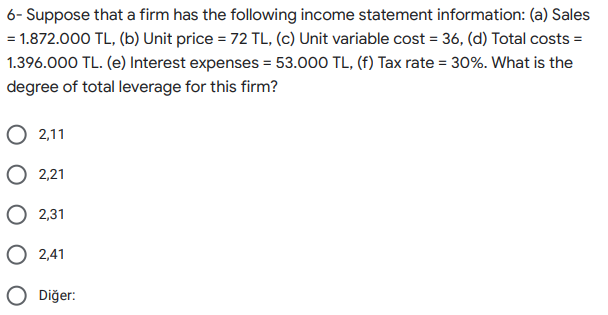

4- What is the crossover rate in the previous question? 11,275% O 12,275% O 13,275% O 14,275% O Dier: 5- Which one of the following statements is FALSE regarding operating leverage? O A company that has a high DOL has a high business risk. ODOL is a measure of sensitivity of a firm's EBIT to a change in sales. O The higher the DOL, the closer the company to its break-even point. O Operating leverage mainly focus on the use of variable operating costs by a company. O Dier 6-Suppose that a firm has the following income statement information: (a) Sales = 1.872.000 TL, (b) Unit price = 72 TL, (c) Unit variable cost = 36, (d) Total costs = 1.396.000 TL. (e) Interest expenses = 53.000 TL, (f) Tax rate = 30%. What is the degree of total leverage for this firm? 0 2,11 0 2,21 0 2,31 0 2,41 O Dier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts