Question: 4. When calculating taxes, the difference between the acquisition cost and selling price of a house is called: a. ordinary income. b. amortization. c. capital

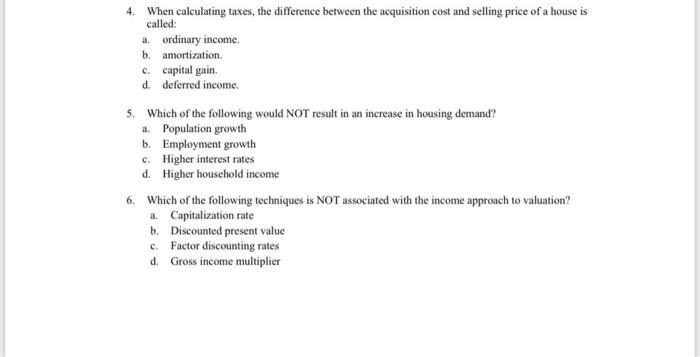

4. When calculating taxes, the difference between the acquisition cost and selling price of a house is called: a. ordinary income. b. amortization. c. capital gain. d. deferred income. 5. Which of the following would NOT result in an increase in housing demand? a. Population growth b. Employment growth c. Higher interest rates d. Higher household income 6. Which of the following techniques is NOT associated with the income approach to valuation? a. Capitalization rate b. Discounted present value c. Factor discounting rates d. Gross income multiplier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts