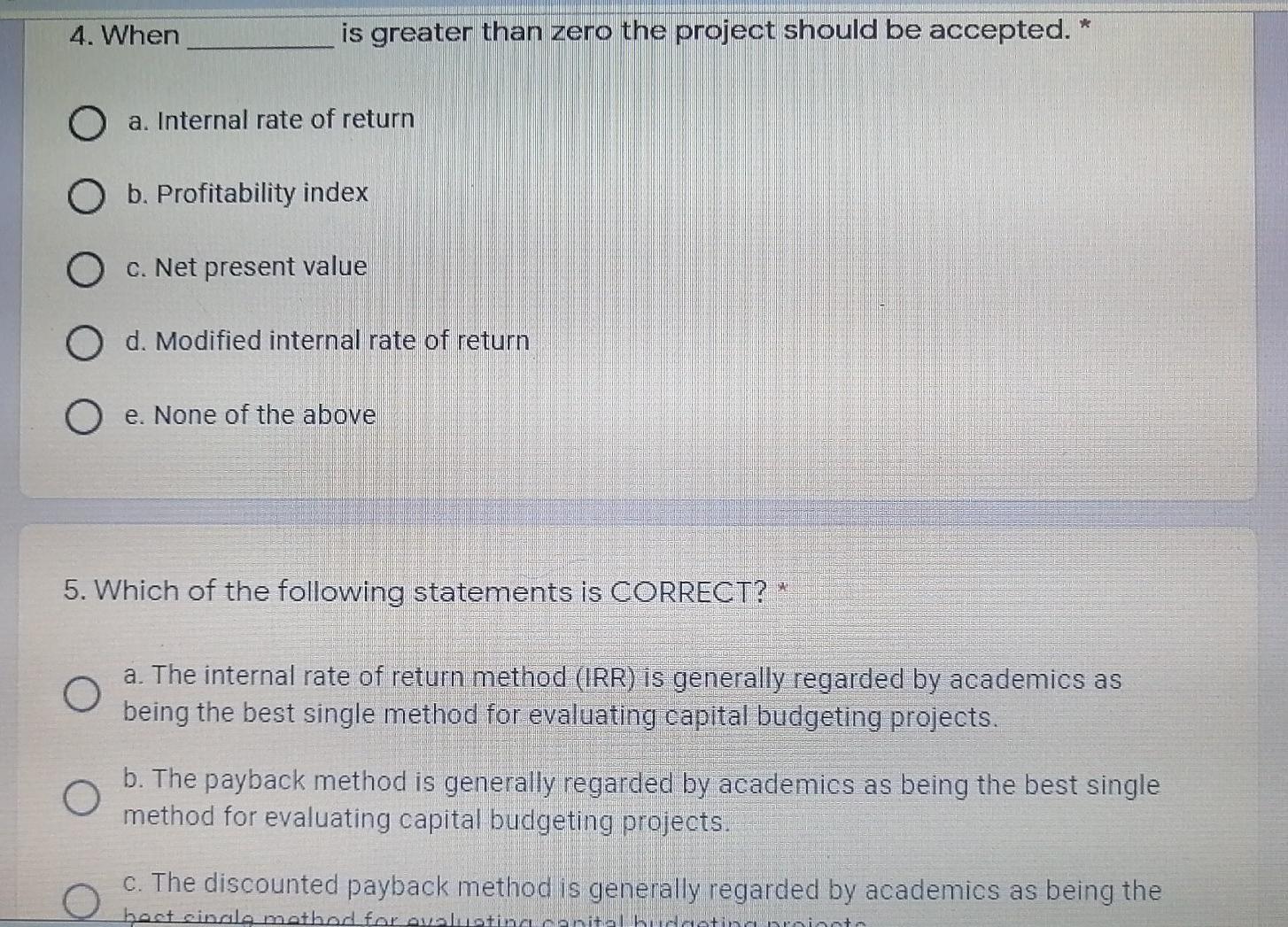

Question: 4. When is greater than zero the project should be accepted. O a. Internal rate of return O b. Profitability index O c. Net present

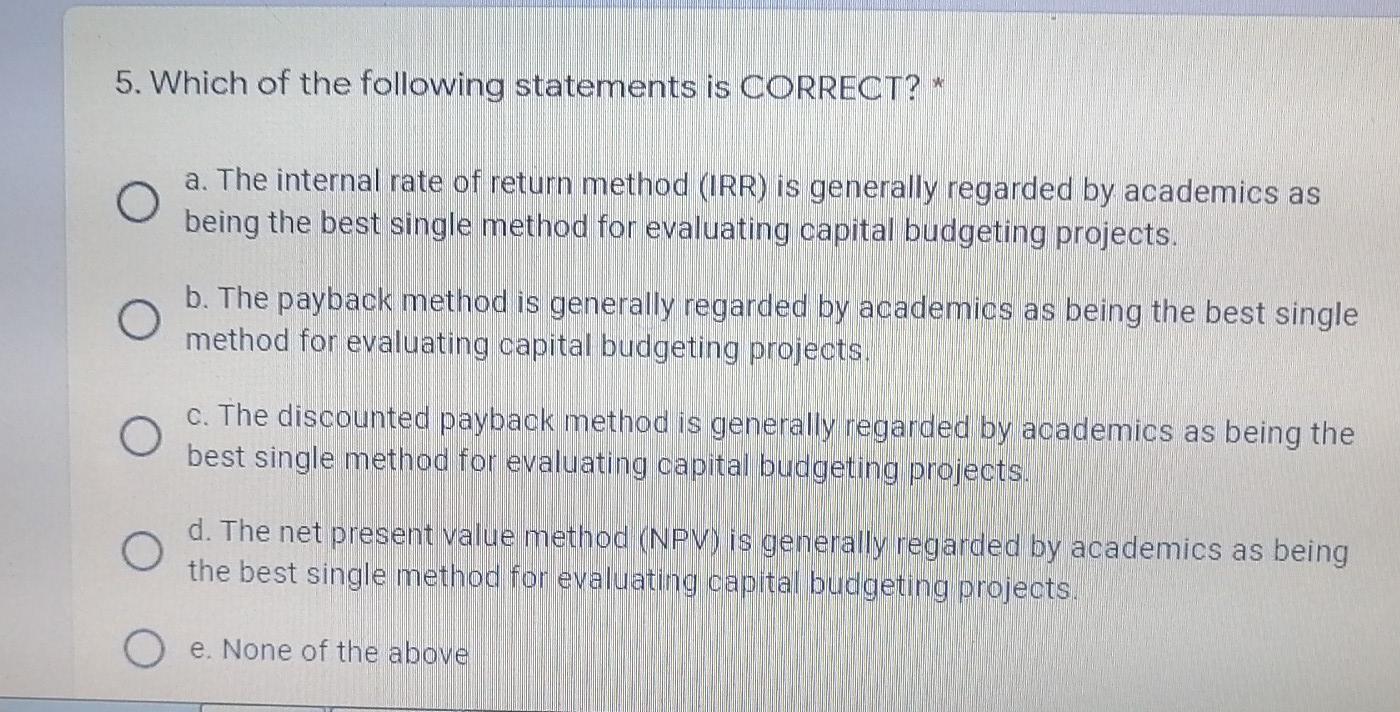

4. When is greater than zero the project should be accepted. O a. Internal rate of return O b. Profitability index O c. Net present value O d. Modified internal rate of return O e. None of the above 5. Which of the following statements is CORRECT? O a. The internal rate of return method (IRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects. O b. The payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects. O c. The discounted payback method is generally regarded by academics as being the host cinale method for avalustina apital huda 5. Which of the following statements is CORRECT? O a. The internal rate of return method (IRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects. O b. The payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects. O c. The discounted payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects. O d. The net present value method (NPV) is generally regarded by academics as being the best single method for evaluating capital budgeting projects. O e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts