Question: 4. Yamaha Corp. s current-year dividend was $2. It is expected that the aividend wit grow at 30% for three years. After three years, the

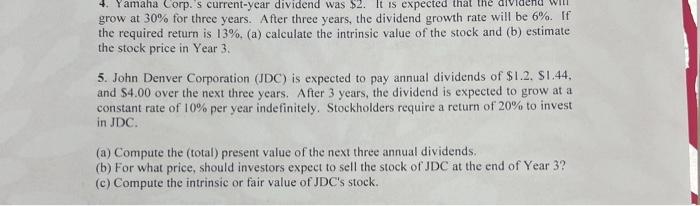

4. Yamaha Corp. s current-year dividend was $2. It is expected that the aividend wit grow at 30% for three years. After three years, the dividend growth rate will be 6%. If the required return is 13%, (a) calculate the intrinsic value of the stock and (b) estimate the stock price in Year 3. 5. John Denver Corporation (JDC) is expected to pay annual dividends of \$1.2. \$1.44, and $4.00 over the next three years. After 3 years, the dividend is expected to grow at a constant rate of 10% per year indefinitely. Stockholders require a return of 20% to invest in JDC. (a) Compute the (total) present value of the next three annual dividends. (b) For what price, should investors expect to sell the stock of JDC at the end of Year 3 ? (c) Compute the intrinsic or fair value of JDC's stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts