Question: 4. Yield to Maturity [[] LO2] Treasury bid and ask quotes are sometimes given in terms of yields, so there would be a bid yield

![4. Yield to Maturity [[] LO2] Treasury bid and ask quotes](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f956fd75d65_76566f956fd17bfd.jpg)

![larger? Explain. - Coupon Rate [] How does a bond issuer decide](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f956ff56046_76666f956fee43be.jpg)

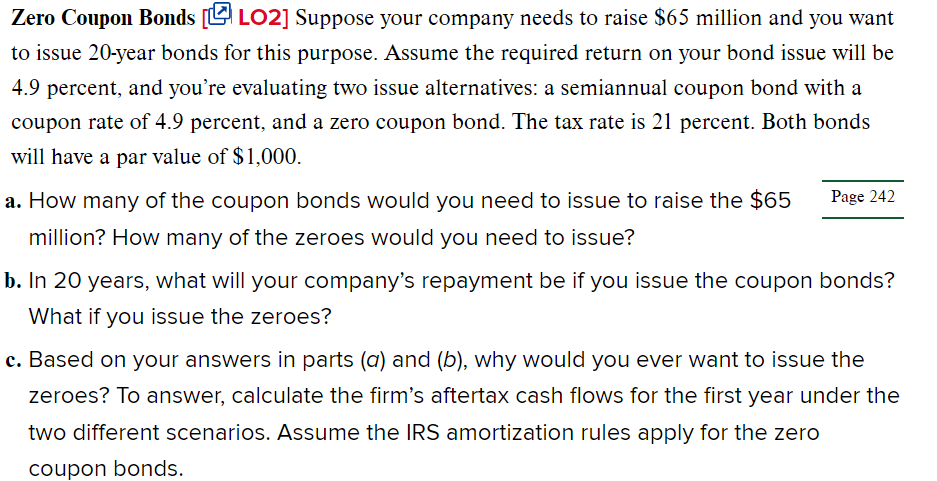

4. Yield to Maturity [[] LO2] Treasury bid and ask quotes are sometimes given in terms of yields, so there would be a bid yield and an ask yield. Which do you think would be larger? Explain. - Coupon Rate [] How does a bond issuer decide on the appropriate coupon rate to set on its bonds? Explain the difference between the coupon rate and the required return on a bond. 9. Bond Ratings [[]l LO3] Often, junk bonds are not rated. Why? Bond Price Movements [ LO2] Bond X is a premium bond making semiannual payments. The bond pays a coupon rate of 6.8 percent, has a YTM of 6.2 percent, and has 13 years to maturity. Bond Y is a discount bond making semiannual payments. This bond pays a coupon rate of 6.2 percent, has a YTM of 6.8 percent, and also has 13 years to maturity. The bonds have a par value of $1,000. What is the price of each bond today? If interest rates remain unchanged, what do you expect the price of these bonds to be 1 year from now? In 3 years? In 8 years? In 12 years? In 13 years? What's going on here? Illustrate your answers by graphing bond prices versus time to maturity. Zero Coupon Bonds [[] LO2] Suppose your company needs to raise $65 million and you want to issue 20-year bonds for this purpose. Assume the required return on your bond issue will be 4.9 percent, and you're evaluating two issue alternatives: a semiannual coupon bond with a coupon rate of 4.9 percent, and a zero coupon bond. The tax rate is 21 percent. Both bonds will have a par value of $1,000. a. How many of the coupon bonds would you need to issue to raise the $65 Page 242 million? How many of the zeroes would you need to issue? b. In 20 years, what will your company's repayment be if you issue the coupon bonds? What if you issue the zeroes? c. Based on your answers in parts (a) and (b), why would you ever want to issue the zeroes? To answer, calculate the firm's aftertax cash flows for the first year under the two different scenarios. Assume the IRS amortization rules apply for the zero coupon bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts