Question: 4. You are deciding between 3 different mutual funds, A, B and C. Fund A has a 4% front-end load. This load means that for

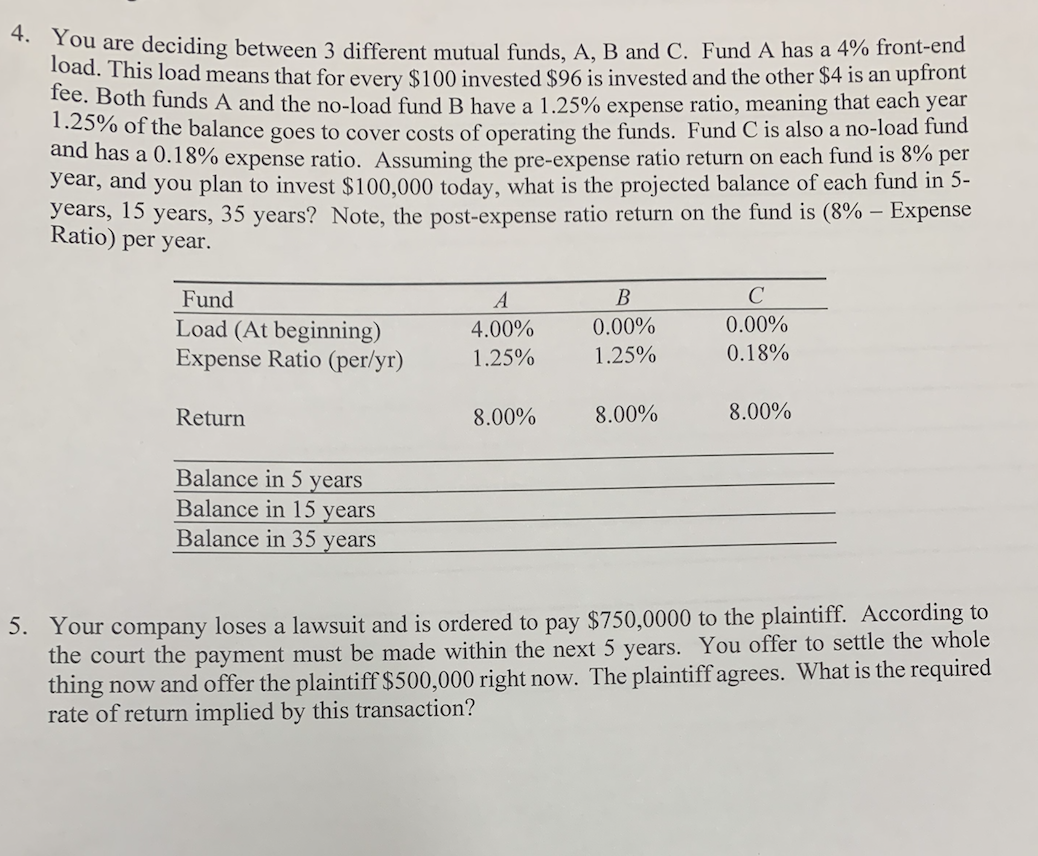

4. You are deciding between 3 different mutual funds, A, B and C. Fund A has a 4% front-end load. This load means that for every $100 invested $96 is invested and the other $4 is an upfront fee. Both funds A and the no-load fund B have a 1.25% expense ratio, meaning that each year 1.25% of the balance goes to cover costs of operating the funds. Fund C is also a no-load fund and has a 0.18% expense ratio. Assuming the pre-expense ratio return on each fund is 8% per year, and you plan to invest $100,000 today, what is the projected balance of each fund in 5- years, 15 years, 35 years? Note, the post-expense ratio return on the fund is (8% Expense Ratio) per year. Fund Load (At beginning) Expense Ratio (per/yr) A 4.00% 1.25% B 0.00% 1.25% 0.00% 0.18% Return 8.00% 8.00% 8.00% Balance in 5 years Balance in 15 years Balance in 35 years 5. Your company loses a lawsuit and is ordered to pay $750,0000 to the plaintiff. According to the court the payment must be made within the next 5 years. You offer to settle the whole thing now and offer the plaintiff $500,000 right now. The plaintiff agrees. What is the required rate of return implied by this transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts