Question: 4 . ) You are evaluating two machines. Machine A has an initial cost of $ 3 4 0 , 0 0 0 and then

You are evaluating two machines. Machine A has an initial cost of $ and then an

annual operating cost of $ per year for its year life. Machine has an initial cost of

$ and then annual operating costs of $ per year for its year life. Your discount

rate is

a Which machine would you select if you did not have to replace the machine at the end of its

life?

b Which machine would you select if you did have to replace it

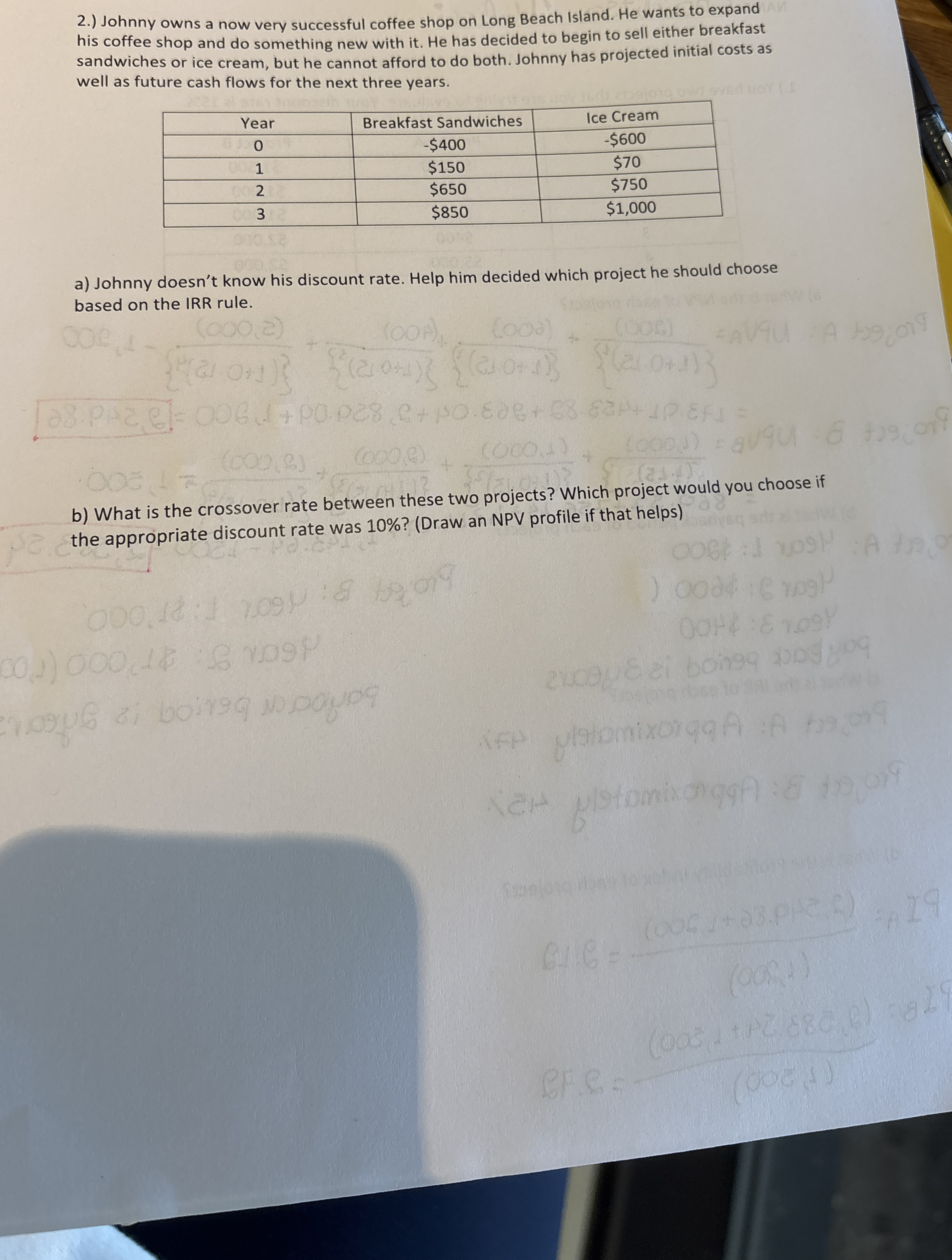

Johnny owns a now very successful coffee shop on Long Beach Island. He wants to expand

his coffee shop and do something new with it He has decided to begin to sell either breakfast

sandwiches or ice cream, but he cannot afford to do both. Johnny has projected initial costs as

well as future cash flows for the next three years.

a Johnny doesn't know his discount rate. Help him decided which project he should choose

based on the IRR rule.

b What is the crossover rate between these two projects? Which project would you choose if

the appropriate discount rate was Draw an NPV profile if that helps

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock