Question: 4. You bought a $1,000 face value Pfizer callable bond in September 2020 that is callable at 101 in 2025 and 2026 and at par

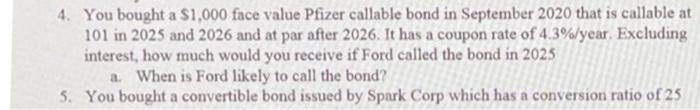

4. You bought a $1,000 face value Pfizer callable bond in September 2020 that is callable at 101 in 2025 and 2026 and at par after 2026. It has a coupon rate of 4.3%/year. Excluding interest, how much would you receive if Ford called the bond in 2025 a. When is Ford likely to call the bond? 5. You bought a convertible bond issued by Spark Corp which has a conversion ratio of 25

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock