Question: 4. You find a zero coupon bond with a par value of $10,000 and 20 years to maturity. If the yield to maturity on this

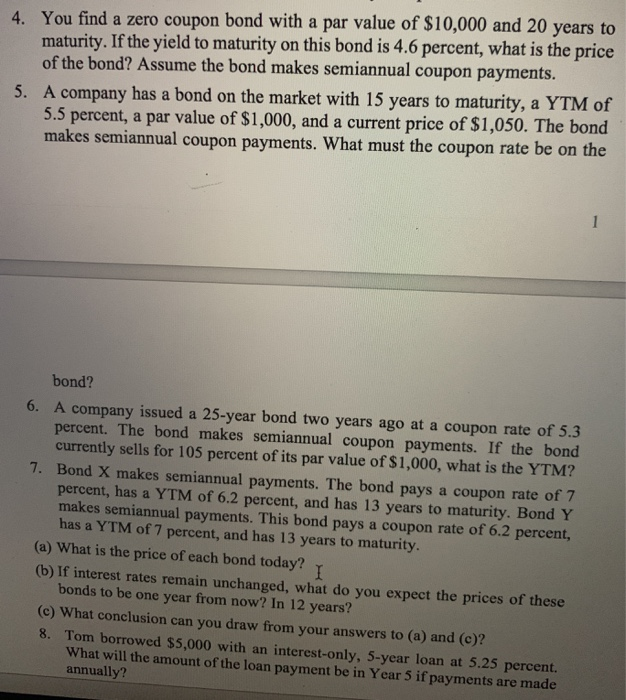

4. You find a zero coupon bond with a par value of $10,000 and 20 years to maturity. If the yield to maturity on this bond is 4.6 percent, what is the price of the bond? Assume the bond makes semiannual coupon payments. 5. A company has a bond on the market with 15 years to maturity, a YTM of 5.5 percent, a par value of $1,000, and a current price of $1,050. The bond makes semiannual coupon payments. What must the coupon rate be on the bond? 6. A company issued a 25-year bond two years ago at a coupon rate of 5.3 percent. The bond makes semiannual coupon payments. If the bond currently sells for 105 percent of its par value of $1,000, what is the YTM? 1. Bond X makes semiannual payments. The bond pays a coupon rate of 7 percent, has a YTM of 6.2 percent, and has 13 years to maturity. Bond Y makes semiannual payments. This bond pays a coupon rate of 6.2 percent, has a YTM of 7 percent, and has 13 years to maturity. (a) What is the price of each bond today? Y (b) If interest rates remain unchanged, what do you expect the prices of these bonds to be one year from now? In 12 years? (c) What conclusion can you draw from your answers to (a) and (c)? 8. Tom borrowed $5,000 with an interest-only, 5-year loan at 5.25 percent. What will the amount of the loan payment be in Year 5 if payments are made annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts