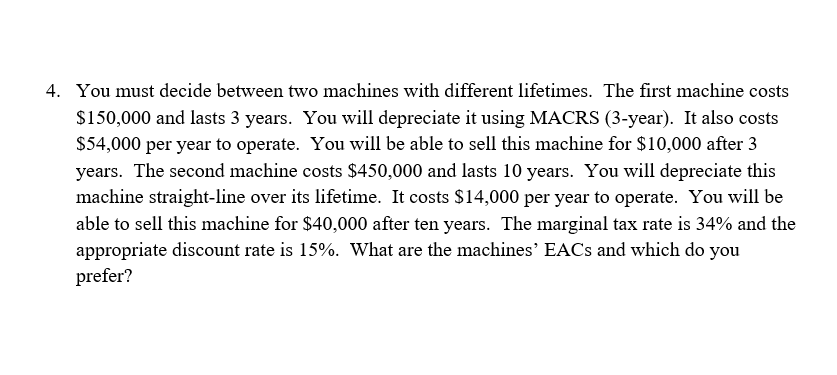

Question: 4. You must decide between two machines with different lifetimes. The first machine costs $150,000 and lasts 3 years. You will depreciate it using MACRS

4. You must decide between two machines with different lifetimes. The first machine costs $150,000 and lasts 3 years. You will depreciate it using MACRS (3-year). It also costs $54,000 per year to operate. You will be able to sell this machine for $10,000 after 3 years. The second machine costs $450,000 and lasts 10 years. You will depreciate this machine straight-line over its lifetime. It costs $14,000 per year to operate. You will be able to sell this machine for $40,000 after ten years. The marginal tax rate is 34% and the appropriate discount rate is 15%. What are the machines' EACs and which do you prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts