Question: #40 #41 #42 three in one please help a Cardinal Company is considering a five-year project that would require a $2,870,000 investment in equipment with

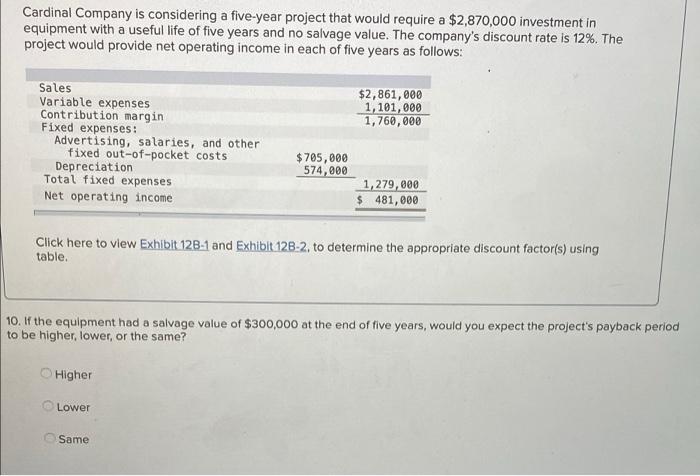

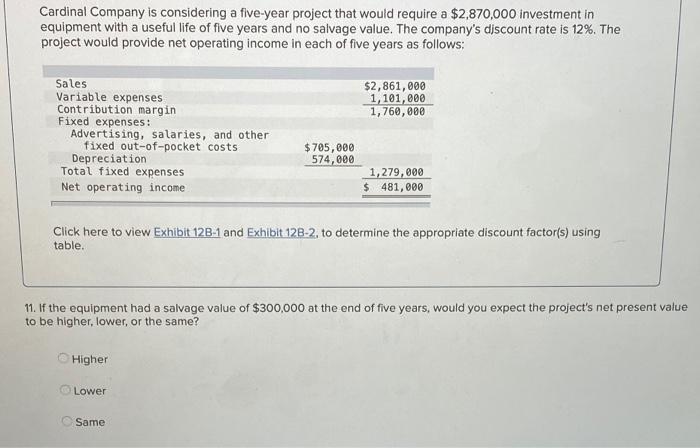

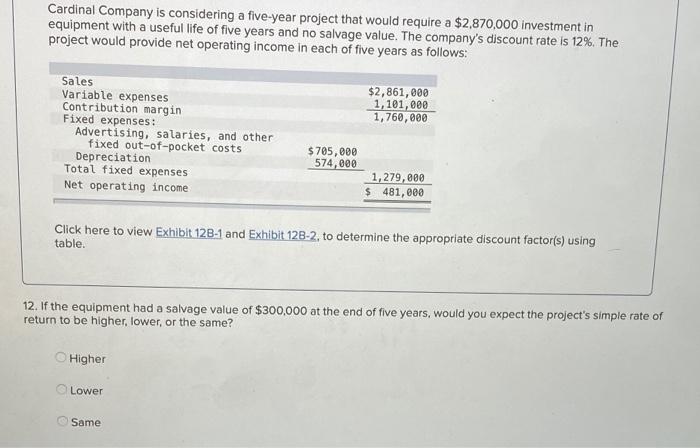

a Cardinal Company is considering a five-year project that would require a $2,870,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: $2,861,000 1,101,000 1,760,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $705,000 574,000 1,279,000 $ 481,000 Click here to view Exhibit 12B-1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table. 10. If the equipment had a salvage value of $300,000 at the end of five years, would you expect the project's payback period to be higher, lower, or the same? Higher Lower Same Cardinal Company is considering a five-year project that would require a $2,870,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: $2,861,000 1,101,000 1,760,000 Sales Variable expenses Contribution margin Fixed expenses : Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $ 705,000 574,000 1,279,000 $ 481,000 Click here to view Exhibit 12B-1 and Exhibit 128-2, to determine the appropriate discount factor(s) using table. 11. If the equipment had a salvage value of $300,000 at the end of five years, would you expect the project's net present value to be higher, lower, or the same? Higher Lower Same Cardinal Company is considering a five-year project that would require a $2,870,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 12%. The project would provide net operating income in each of five years as follows: $2,861,000 1,101,000 1,760,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses Net operating income $705,000 574,000 1,279,000 $ 481,000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. 12. If the equipment had a salvage value of $300,000 at the end of five years, would you expect the project's simple rate of return to be higher, lower, or the same? Higher Lower Same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts