Question: 40 ed You are going to withdraw $1,000 at the end of each year for the next three years from an account that pays interest

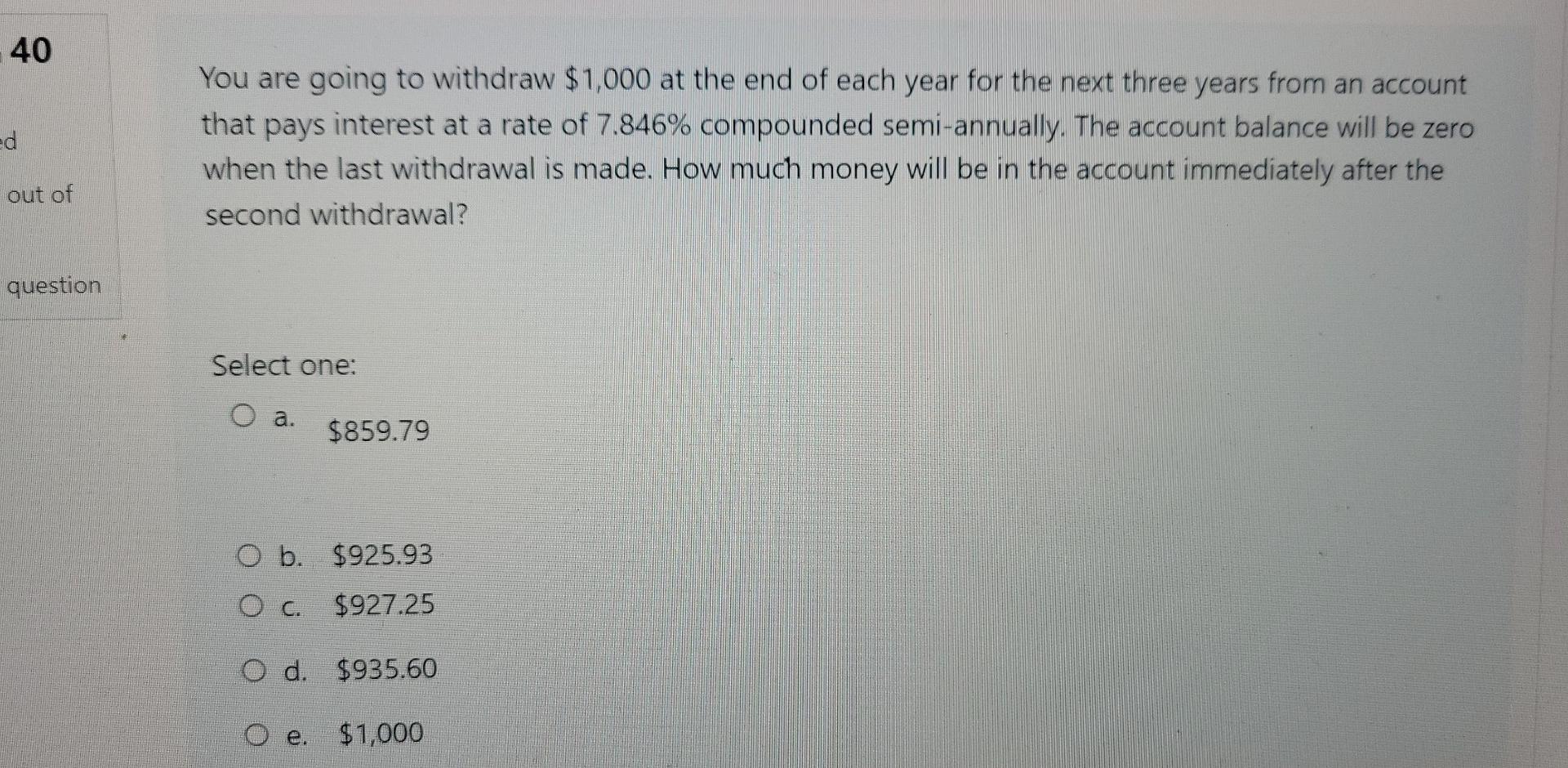

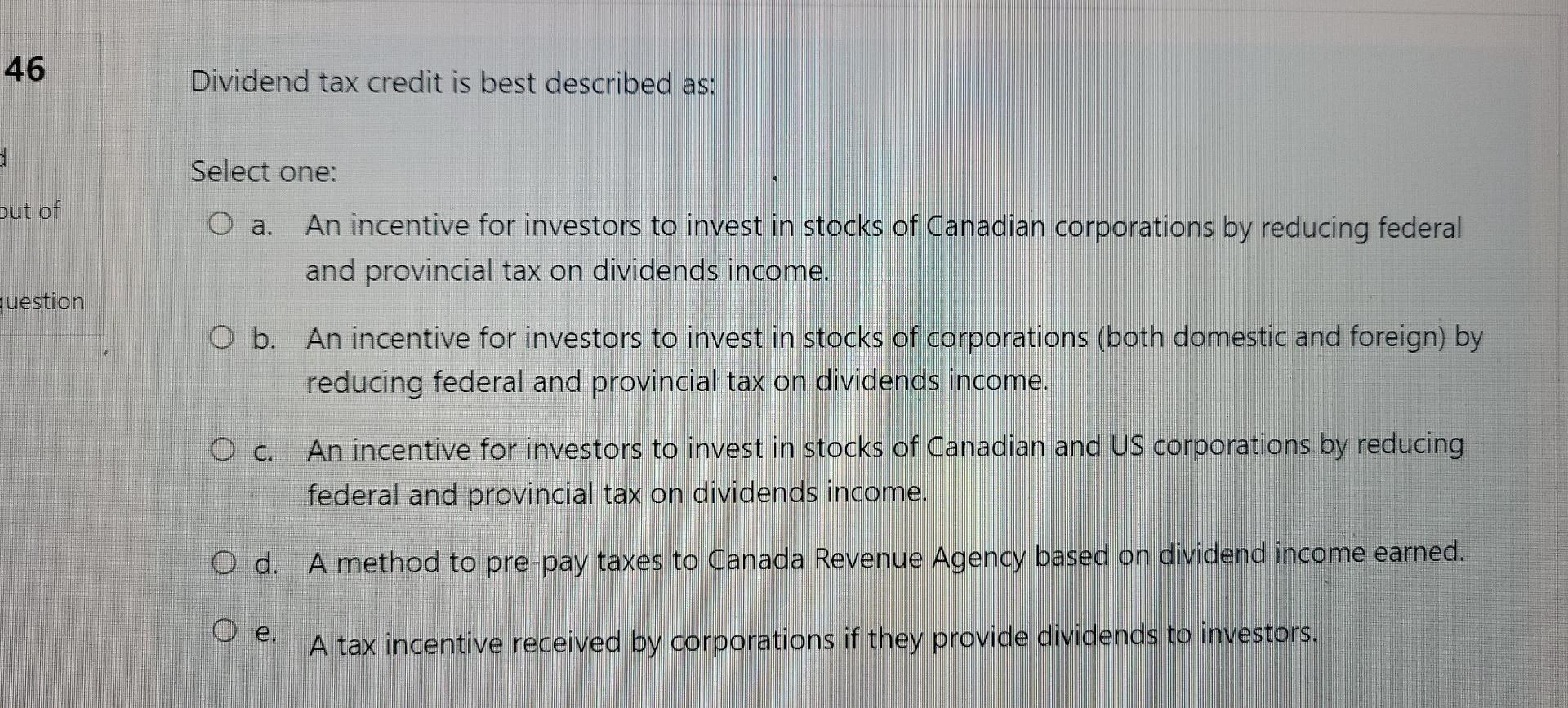

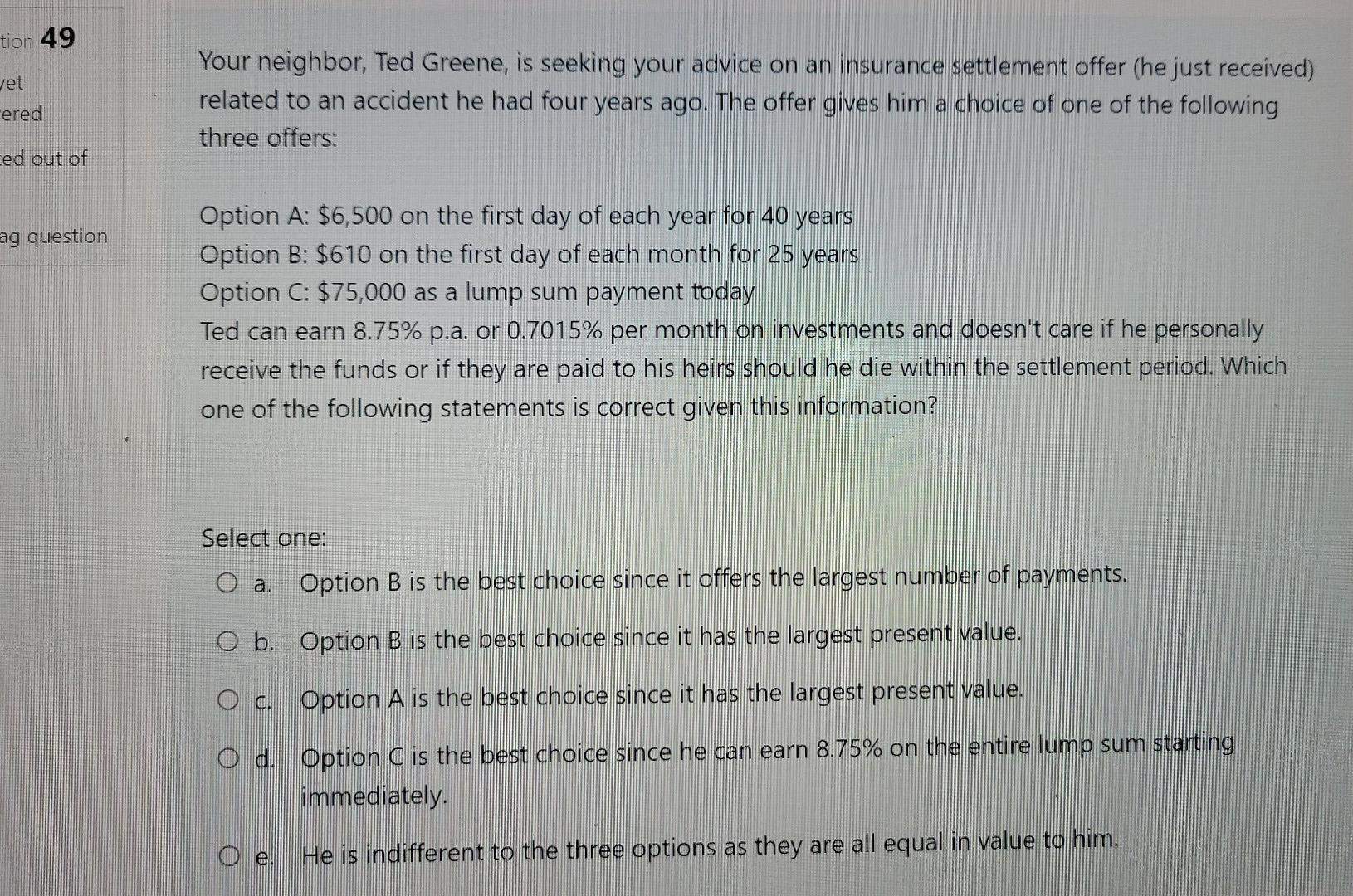

40 ed You are going to withdraw $1,000 at the end of each year for the next three years from an account that pays interest at a rate of 7.846% compounded semi-annually. The account balance will be zero when the last withdrawal is made. How much money will be in the account immediately after the second withdrawal? out of question Select one: a. $859.79 O b. $925.93 O c. $927.25 O d. $935.60 O e. $1,000 46 Dividend tax credit is best described as: Out of Select one: O a. An incentive for investors to invest in stocks of Canadian corporations by reducing federal and provincial tax on dividends income. question O b. An incentive for investors to invest in stocks of corporations (both domestic and foreign) by reducing federal and provincial tax on dividends income. O c. An incentive for investors to invest in stocks of Canadian and US corporations by reducing federal and provincial tax on dividends income. O d. A method to pre-pay taxes to Canada Revenue Agency based on dividend income earned. O e. A tax incentive received by corporations if they provide dividends to investors. tion 49 Jet ered Your neighbor, Ted Greene, is seeking your advice on an insurance settlement offer (he just received) related to an accident he had four years ago. The offer gives him a choice of one of the following three offers: ced out of ag question Option A: $6,500 on the first day of each year for 40 years Option B: $610 on the first day of each month for 25 years Option C: $75,000 as a lump sum payment today Ted can earn 8.75% p.a. or 0.7015% per month on investments and doesn't care if he personally receive the funds or if they are paid to his heirs should he die within the settlement period. Which one of the following statements is correct given this information? Select one: a. Option B is the best choice since it offers the largest number of payments. O b. Option B is the best choice since it has the largest present value. o. Option A is the best choice since it has the largest present value. O d. Option C is the best choice since he can earn 8.75% on the entire lump sum starting immediately Ole He is indifferent to the three options as they are all equal in value to him

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts