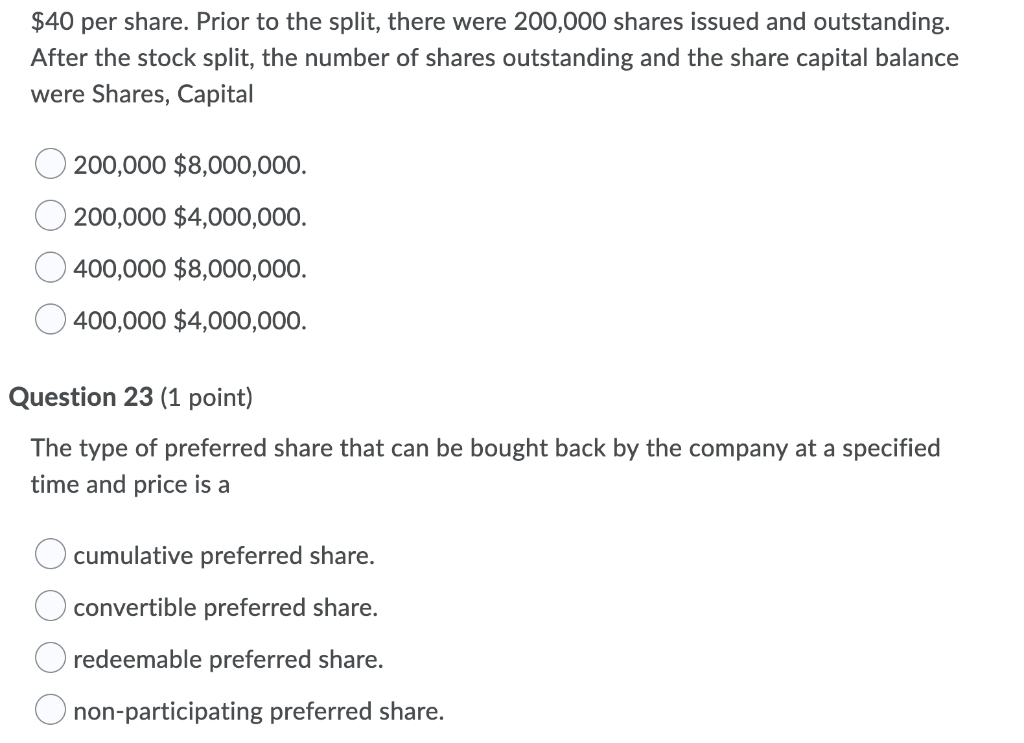

Question: $40 per share. Prior to the split, there were 200,000 shares issued and outstanding. After the stock split, the number of shares outstanding and the

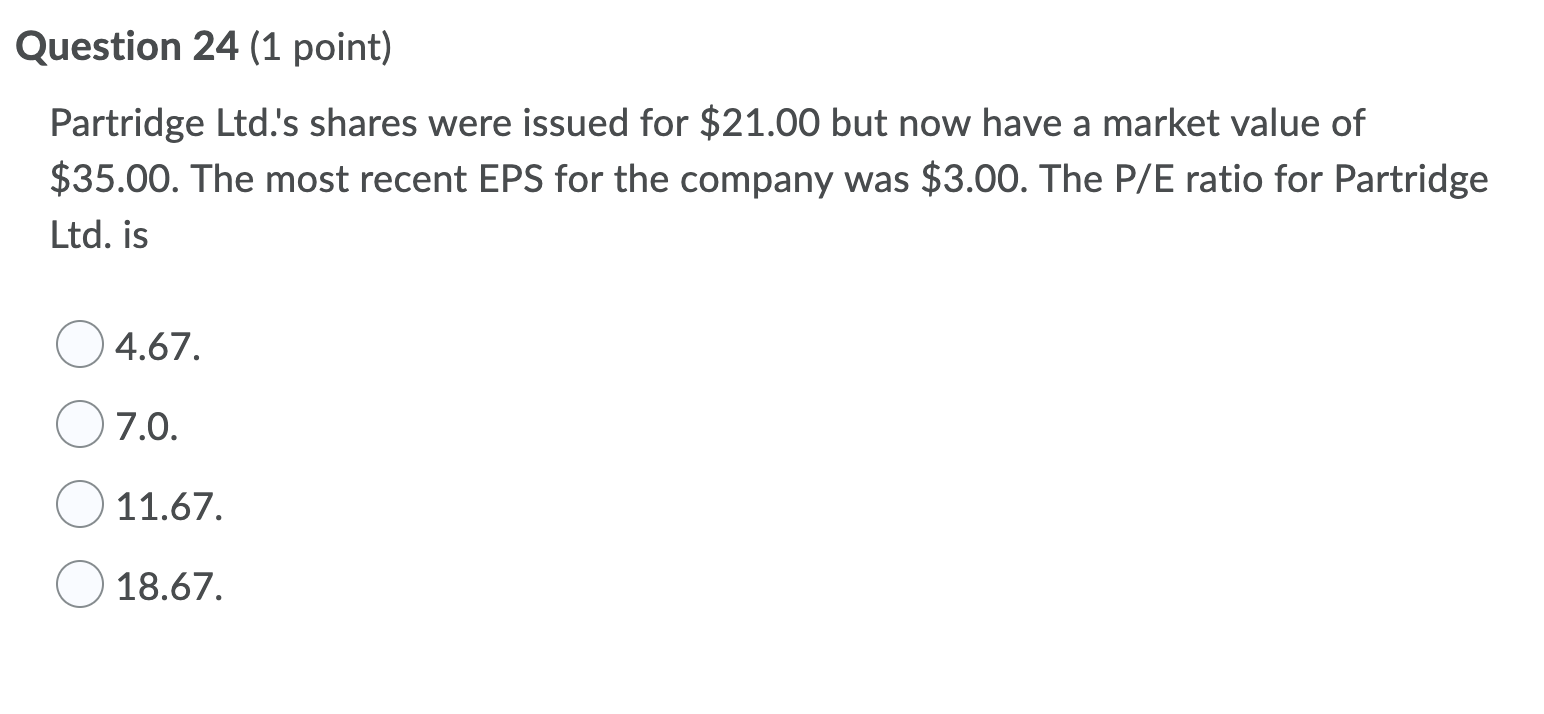

$40 per share. Prior to the split, there were 200,000 shares issued and outstanding. After the stock split, the number of shares outstanding and the share capital balance were Shares, Capital O 200,000 $8,000,000. 200,000 $4,000,000. 400,000 $8,000,000. 400,000 $4,000,000. Question 23 (1 point) The type of preferred share that can be bought back by the company at a specified time and price is a cumulative preferred share. convertible preferred share. O redeemable preferred share. non-participating preferred share. Question 24 (1 point) Partridge Ltd.'s shares were issued for $21.00 but now have a market value of $35.00. The most recent EPS for the company was $3.00. The P/E ratio for Partridge Ltd. is 4.67. 7.0. 11.67. 18.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts