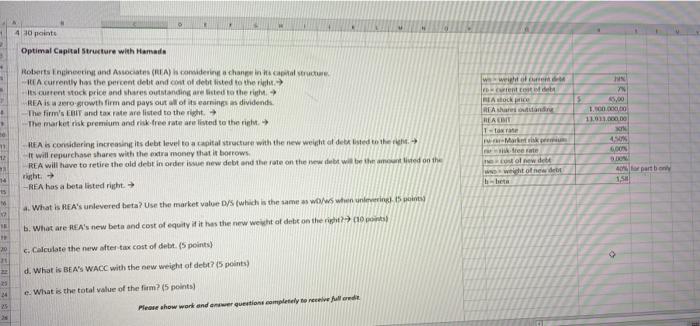

Question: 40 points Optimal Capital Structure with Hamada . $5,00 1.100.000 110.000 DO we wou centos de Asocki Randi RAM lore Maritim tree te How do

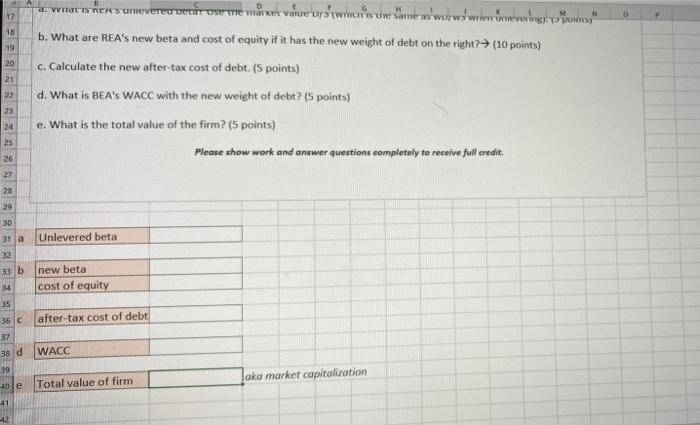

40 points Optimal Capital Structure with Hamada . $5,00 1.100.000 110.000 DO we wou centos de Asocki Randi RAM lore Maritim tree te How do wwel of neede 10: 12 Roberts Engineering and Associates (REA) considering a change in its capital A currently has the percent debit and cost of detit listed to the is current stock price and shares outstanding are listed to the REA is a growth firm and pays out of its earnings as dividende The firm's CBI and tax rate are listed to the right -The market risk premium and risk tree rate are listed to the right REA is considering increasing its debt level to a capital structure with the new weight at det sted to the It will repurchase shares with the extra money that it borrows. REA will have to retire the old debit in order issue new debt and the rate on the new debt will be the amounted on the right REA has a bets listed right What is REA's unlevered beta? Use the market value D/S (which in the same as wows when neering Sports b. What are REA's new beta and cost of equity it it has the new weight of debe on the right? (10 pont c. Calculate the new after tax cost of debt. (5 points) d. What is BEA'S WACC with the new weight of debt? (5 points) 0 GOON Darbo 13 1,500 TE 20 1 24 e. What is the total value of the firm? (5 points) Please show work and answer questions completely to receive full credit 17 N 0 15 19 20 21 2. VITETS REX reveredetar ose me market value wires the same as wuyw wieroeven b. What are REA's new beta and cost of equity if it has the new weight of debt on the right? (10 points) c. Calculate the new after-tax cost of debt. (5 points) d. What is BEA'S WACC with the new weight of debt? (5 points) e. What is the total value of the firm? (5 points) Please show work and answer questions completely to receive full credit. 22 23 24 25 26 27 28 29 30 31 a Unlevered beta 32 33 b new beta cost of equity 14 35 36 C after-tax cost of debt 37 3 d WACC 39 ako market capitalization 40 le Total value of firm 41 -42 40 points Optimal Capital Structure with Hamada . $5,00 1.100.000 110.000 DO we wou centos de Asocki Randi RAM lore Maritim tree te How do wwel of neede 10: 12 Roberts Engineering and Associates (REA) considering a change in its capital A currently has the percent debit and cost of detit listed to the is current stock price and shares outstanding are listed to the REA is a growth firm and pays out of its earnings as dividende The firm's CBI and tax rate are listed to the right -The market risk premium and risk tree rate are listed to the right REA is considering increasing its debt level to a capital structure with the new weight at det sted to the It will repurchase shares with the extra money that it borrows. REA will have to retire the old debit in order issue new debt and the rate on the new debt will be the amounted on the right REA has a bets listed right What is REA's unlevered beta? Use the market value D/S (which in the same as wows when neering Sports b. What are REA's new beta and cost of equity it it has the new weight of debe on the right? (10 pont c. Calculate the new after tax cost of debt. (5 points) d. What is BEA'S WACC with the new weight of debt? (5 points) 0 GOON Darbo 13 1,500 TE 20 1 24 e. What is the total value of the firm? (5 points) Please show work and answer questions completely to receive full credit 17 N 0 15 19 20 21 2. VITETS REX reveredetar ose me market value wires the same as wuyw wieroeven b. What are REA's new beta and cost of equity if it has the new weight of debt on the right? (10 points) c. Calculate the new after-tax cost of debt. (5 points) d. What is BEA'S WACC with the new weight of debt? (5 points) e. What is the total value of the firm? (5 points) Please show work and answer questions completely to receive full credit. 22 23 24 25 26 27 28 29 30 31 a Unlevered beta 32 33 b new beta cost of equity 14 35 36 C after-tax cost of debt 37 3 d WACC 39 ako market capitalization 40 le Total value of firm 41 -42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts